This article will dive into a crucial topic when it comes to investing in residential real estate in Panama: Property Taxes.

But don’t worry… I won’t drown you in complex jargon or bureaucratic mumbo-jumbo. We will try to keep things light and straightforward, and I’ll also provide illustrative examples.

In fact, I’ll even provide a little Excel model that you can download to estimate property taxes on a residential property based on current rates.

Before we get started, let me drop just a quick couple of quick disclaimers.

Disclaimer 1 – This article will explain the standard property tax regime for residential properties since January 1, 2019. And I’ll also tell you about an alternative tax rate if your investment qualifies as your primary residence.

But this article doesn’t cover absolutely everything about residential property taxes in Panama. For example, I won’t get into property tax exonerations that may benefit some properties. And there may be other circumstances not covered here that affect the taxes levied against a particular property.

Disclaimer 2 – This article also does not purport to give tax advice. Before making any investment, you should consult with a tax advisor (I can refer you). You should also allow me or another attorney to run a due diligence on the specific property.

Let’s get started!

Panama Property Taxes Overview

Property taxes in Panama are less complicated than in many other parts of the world. They are also relatively low compared to many other countries. This is music homeowners’ ears.

Panama property taxes are calculated based on the registered value of a.) the land and b.) the construction (often referred to as “improvements”) that make up the property. When calculating property taxes, this value usually is determined by the last value at which the property was sold.

I underlined “usually” because in specific cases the registered value will be updated despite the value at which the property was sold. But I’ll leave that for a future article.

Incentive to Hold Real Estate in a Prop-co

The fact that property taxes are calculated based on the last value at which the property was sold creates an interesting incentive to hold properties in a property holding company (a ” Prop-co”). Here is what I mean:

- The registered value may be completely different (and much lower) than the market value of the property.

- When you buy a property by acquiring the shares of a Prop-co, the property remains registered to the company. This means the property technically is not “sold”. This means the registered value of the property will generally not be updated or adjusted based on the transaction value.

Let’s say you purchased an apartment 10 years ago for $150k, and you hold it in a sociedad anónima (S.A.). The registered value was likely set at $150k when you bought it. This would have served as the basis for your property taxes over the last 10 years. But now somebody has offered to buy the same apartment from you for $450k. If they purchase the property directly, the registered value will be adjusted to the new $450k price point. That means the buyer will pay property taxes based on $450k going forward. But if they purchase the property by acquiring the shares of your S.A., the registered value will remain at $150k. This lower tax basis will save the buyer money for years to come.

Read more about the benefits of using the shares of an S.A. corporation to transfer real estate.

Annual Property Tax Installments

Also important – property taxes are paid in 3 separate payments during the year (in April, August and December). So, for example, $900 in annual property taxes should be paid in 3 installments of $300 each.

Now, let’s dive into the numbers. First, I’ll tell you about the standard property tax rate that applies to residential real estate acquired as an investment. Then, I’ll tell you about the better tax rate that applies if your residential property qualifies for the primary home benefit.

Property Taxes on Residential Real Estate (Investment Property)

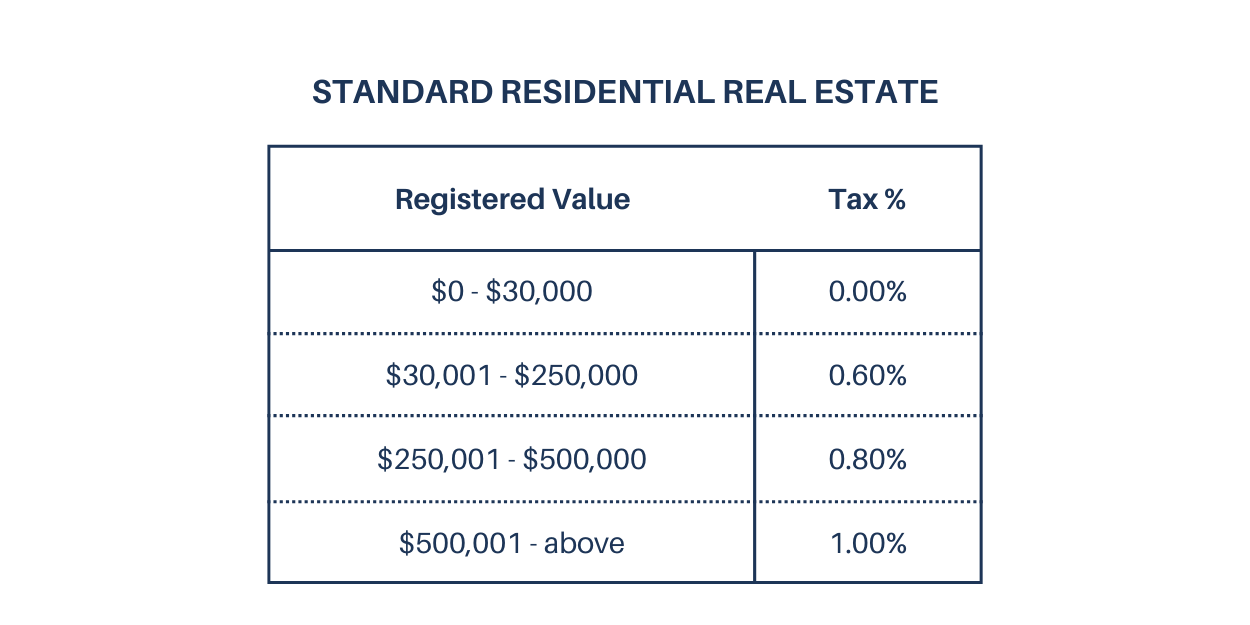

Assuming no special considerations or specific exonerations apply, property taxes are generally calculated on residential real estate as follows:

As you can see, the first $30k in registered value is exempt from property taxes. Then beyond that initial exempt value, a graduated tax rate applies to the property depending on its total registered value.

Let’s see a couple of illustrative examples to understand how this works in practice.

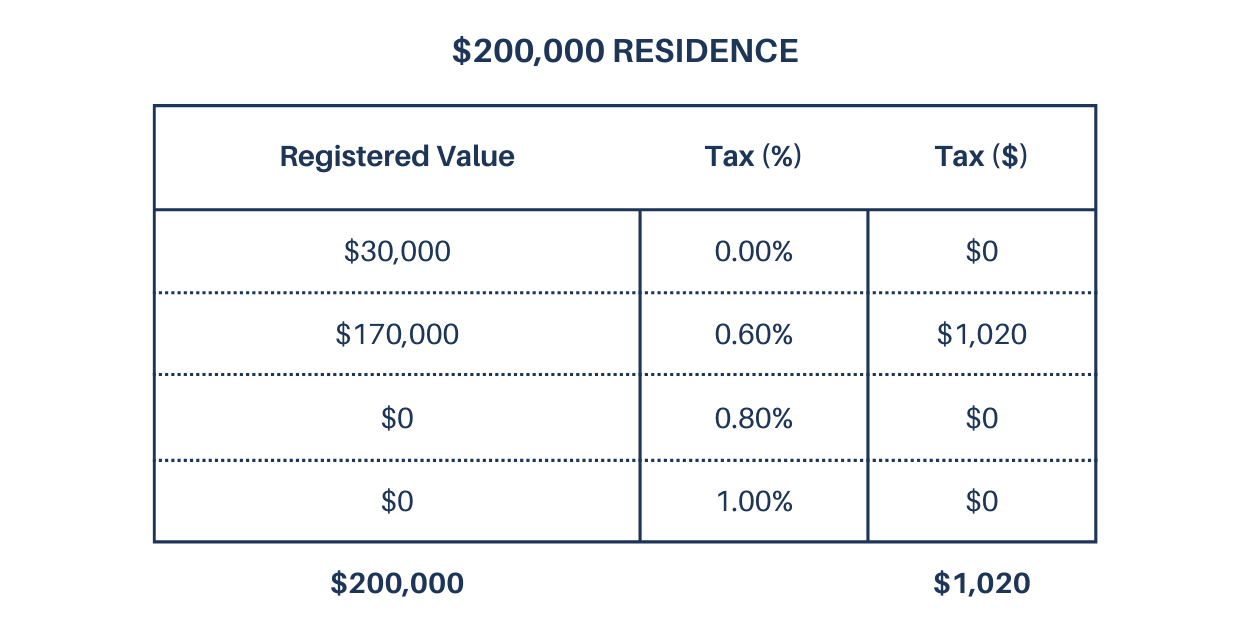

$200k Residence

First, let’s say you are buying a residential property for $200,000. Assuming no special conditions or exonerations that apply, your annual property tax obligation would be around $1,020. Here is what that looks like:

Again, the first $30k in value is exempt from property taxes. The remainder of the $200k value ($170k) is taxed in that second bracket at 0.6%. Easy-peasy.

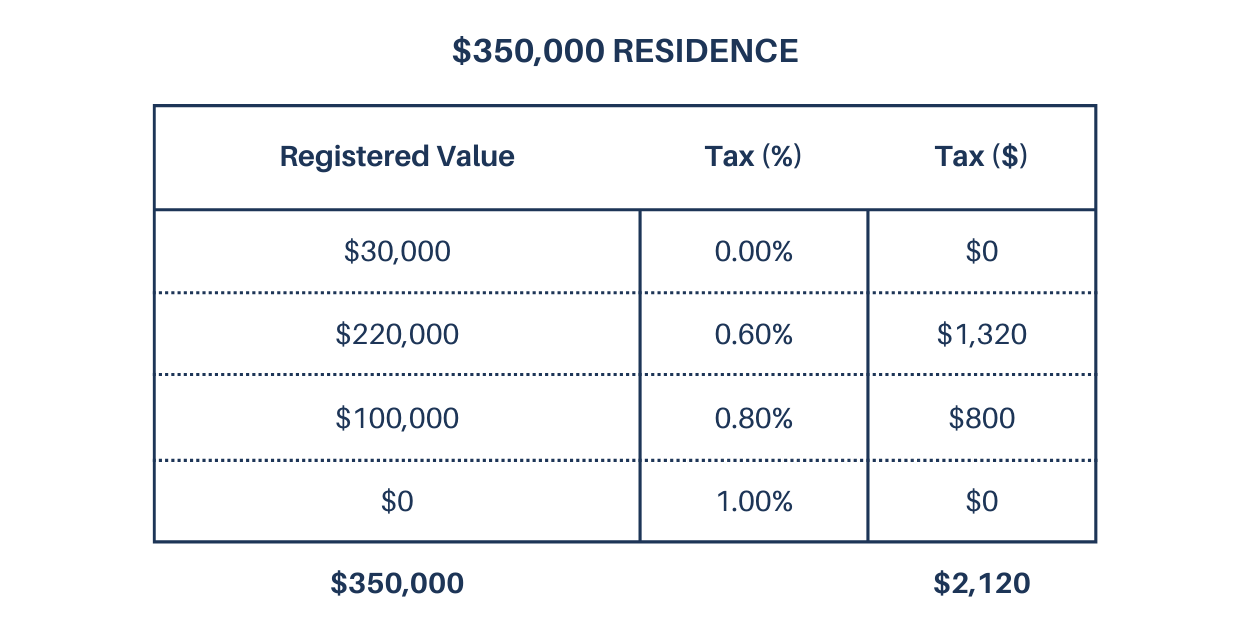

$350k Residence

But now, let’s say you instead decided to buy something at a higher price point of $350k. You could anticipate your annual property tax obligation to be around $2,120 (again, barring any special considerations):

The $350k price tag means that $100k of the value is taxed in that third bracket at 0.8%.

$700k Residence

Ok, just one more. Now you are buying a residential property for $700k. Ok, Mr. Moneybags – now you can anticipate annual property taxes to be $5,320 (assuming no exonerations or special circumstances):

Is that clear enough?

Great. But just like the guidance counselor used to say to my husband when he was an awkward junior high school student, “Don’t worry, it gets better!”

Well, it gets better if your residential property investment qualifies for the primary home benefit.

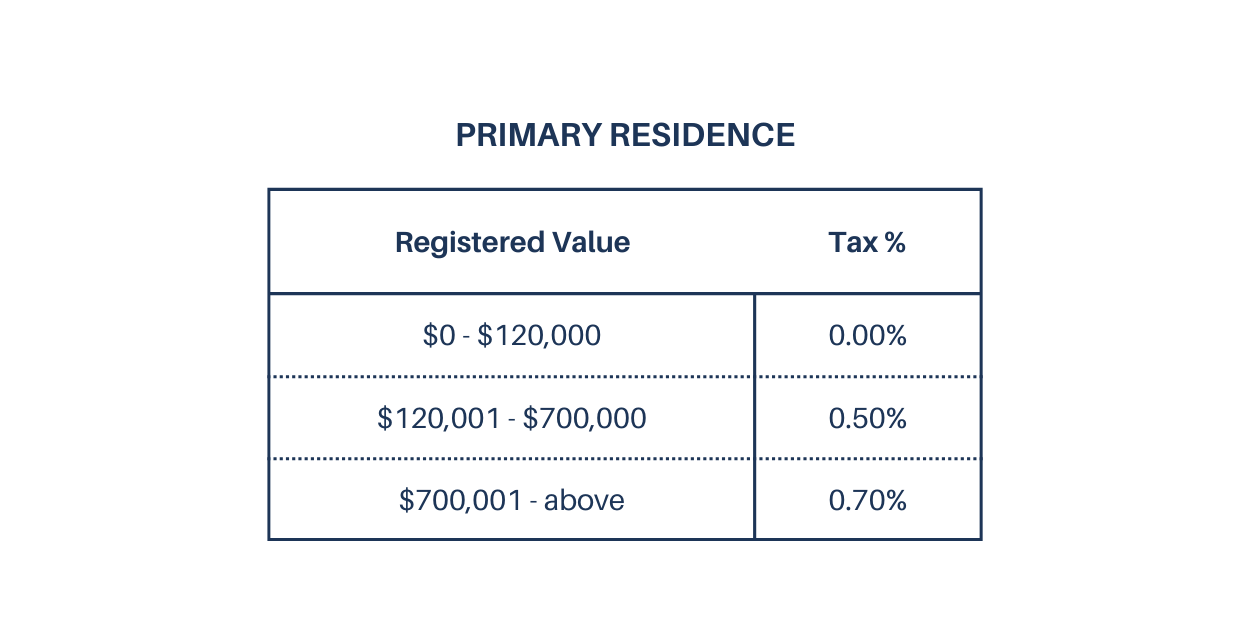

Property Taxes on Residential Real Estate (Primary Residence)

If your property qualifies for the primary home benefit, then you get to work with an even better property tax regime:

As you can see, with the primary home benefit the first $120k in registered value is exempt from property taxes. And the graduated tax rate is also more favorable than the standard residential property tax rate.

This is great news that results in a nice savings on annual property taxes. Let’s run through the 3 example price points to see the impact of the primary home benefit.

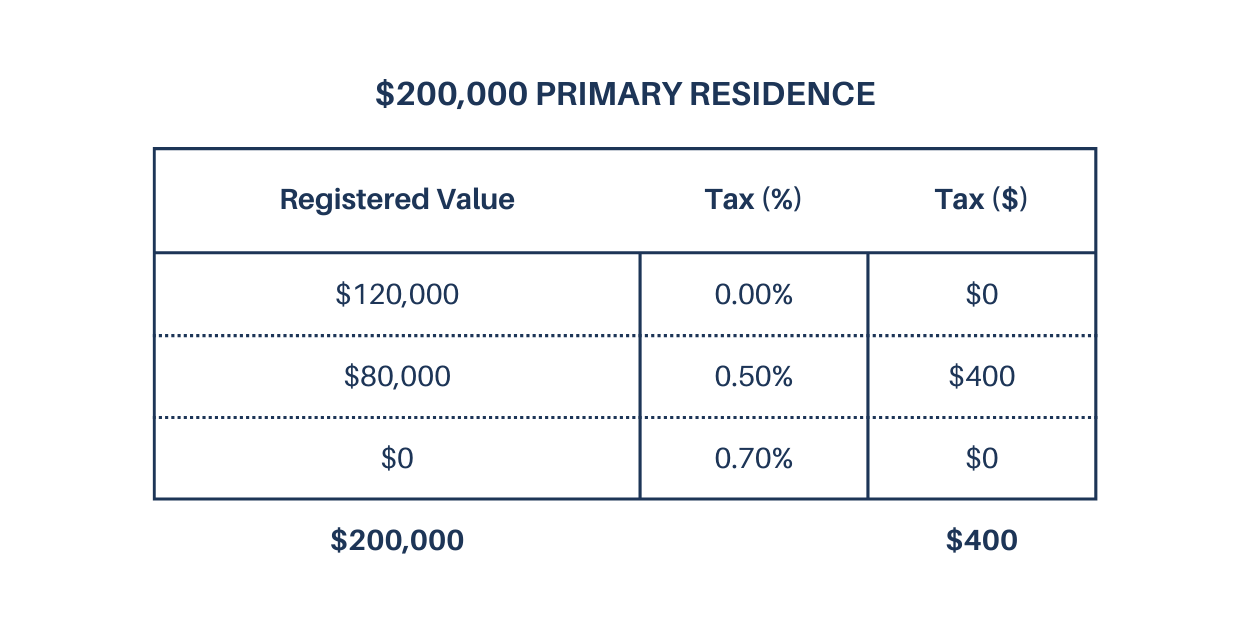

$200k Residence

The $200k residential property referenced above that would normally pay $1,020 in annual property taxes. But if it qualifies for the primary home benefit, it would pay just $400 per year:

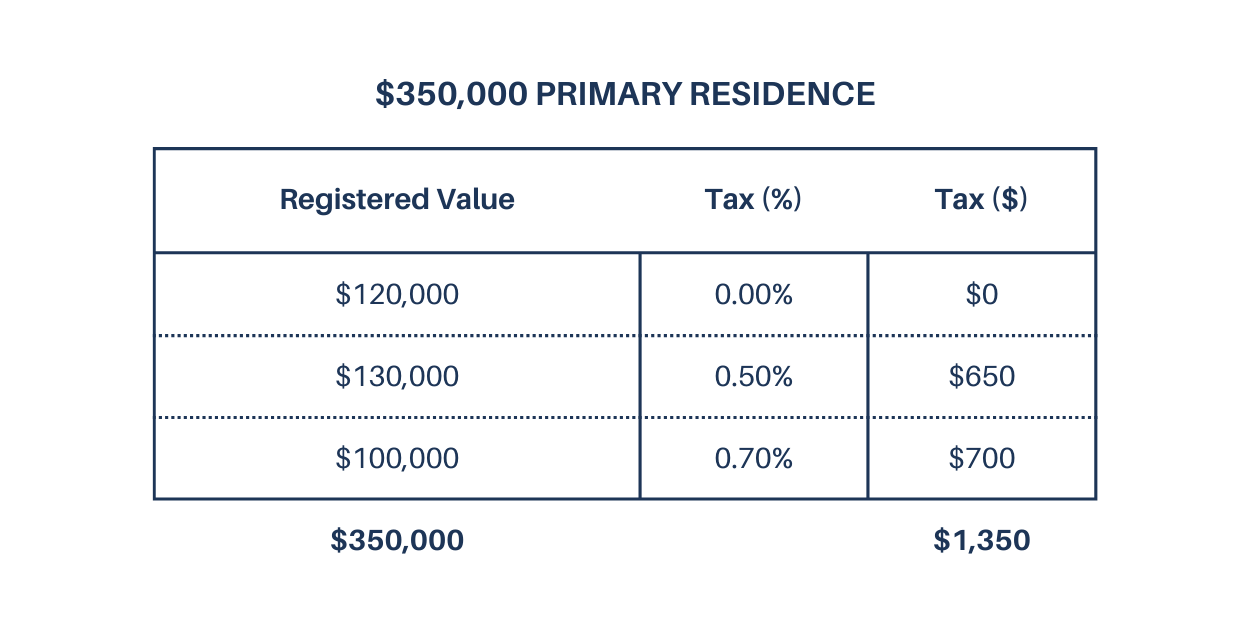

$350k Residence

The $350k residential property referenced above would normally pay $2,120 in annual property taxes. But with the primary home benefit, the same residence would pay just $1,350.

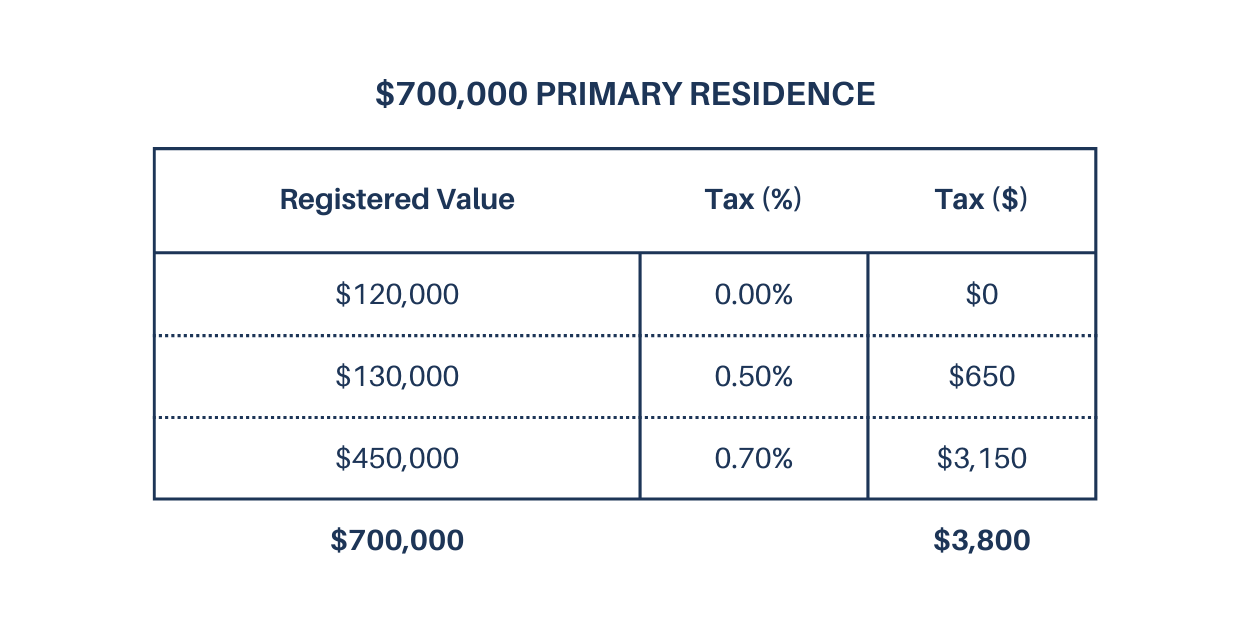

$700k Residence

Finally, while the $700k residence would normally pay $5,320 per year, with the primary home benefit it would pay just $3,800 per year:

Proportional Taxes on Land in a Condominium (Propiedad Horizontal, or “PH”)

One more thing to consider. If you live in a PH, then there is an additional annual property tax calculated as 1% of the registered value of the land, which is divided among the different units in the PH.

And this applies even if the units benefit from an exoneration. So it catches people off guard sometimes if they thought that the exoneration meant they didn’t have to pay any property taxes.

But the good news is that it is typically a relatively small amount – especially if you are living in a tower with lots of units.

Bottom Line?

Here is a little reward for making it to the end! You can download this little Excel model to calculate the property on your residential real estate property (assuming no exonerations or special conditions apply):

RESIDENTIAL REAL ESTATE PROPERTY TAX CALCULATION MODEL

In a nutshell, property taxes in Panama are relatively straightforward and easy on the wallet compared to many other places in the world. And when you’re ready to explore Panama’s real estate opportunities, remember that The Independent Lawyer is available to simplify your journey.

If you have questions about how this might apply to your residential property, then you can write to me at info@theindependentlawyer.com.