Many years ago, some ambitious gentlemen built a big Canal running through Panama, propelling this tiny landbridge onto the world stage with a unique and exclusive role in international commerce.

Thankfully, things have continued to go pretty well since then. Panama’s strategic location coupled with its growing economy and investor-friendly policies have made it widely considered an attractive destination for relocation and access to Latin American economies. This has naturally led to the development of a dynamic real estate market.

And anyone engaging in the Panama real estate market will want to know about the strategic use of corporate entities to hold properties and execute transactions.

Good news – that’s the subject of this article!

Using Corporations for Real Estate Investments

It is very common for local and foreign investors alike to use corporate entities for their real estate investments in Panama, for many of the same reasons investors use corporations to hold real estate all over the world:

- Tax Strategy.

Corporate entities can provide tax advantages that optimize real estate investments. Holding real estate in a corporation enables investors to maximize deductions, reducing the taxable income of the corporation. Additionally, using a corporation allows for more income distribution flexibility. This is beneficial for real estate investors with diverse income profiles. - Limited Liability.

Holding real estate within a corporate entity provides valuable asset protection, shielding shareholders and their other assets from liabilities. Simultaneously, the corporation offers a layer of protection to shareholders against liabilities associated with the specific property.

Read more about using corporate entities to limit liability. - Estate Planning.

A corporate entity can facilitate the transfer of an asset to one’s heirs. This makes it a valuable tool for estate planning, streamlining or even bypassing the lengthy probate process. - Partnerships.

A corporation also facilitates partnerships, since interests in a corporate entity can be divided between multiple people more easily than direct ownership of the underlying assets. An investor entitled to 30% ownership can simply receive 30% of the corporation’s shares. And partners can establish a shareholder agreement to clearly define the rules of their partnership. - Liquidity.

A corporation can also make transferring property rights from one person to another much faster and easier when it comes time to sell.

All of the reasons above come down asset protection, and foreign investors should be strategic in setting up adequate and appropriate holding structures for their Panama assets.

Asset protection isn’t just about limiting liabilities. It is also about protecting your assets from superfluous tax hits. And it’s about ensuring that your assets can be easily transferred when it comes time to sell or pass them on to your heirs.

Asset Protection: What is the Best Holding Structure?

But in the world of Panama real estate, the use of corporate entities isn’t just about asset protection. Corporate entities — and in particular the anonymous society (“sociedad anónima” or “S.A.”) – can also be a valuable tool to achieve seamless property transfers in purchase-sale transactions.

By transferring the shares of an S.A. corporation that owns a real estate property, the parties to a purchase-sale can circumvent the need for property title transfers and escrow accounts. This can make for a notably faster transaction, while also providing significant tax advantages not typically available in regular property transactions.

Selling Real Estate in Panama

To understand why you might want to use an S.A. (“sociedad anónima“) to sell real estate, let’s first take a quick look at how a typical real estate transaction works in Panama.

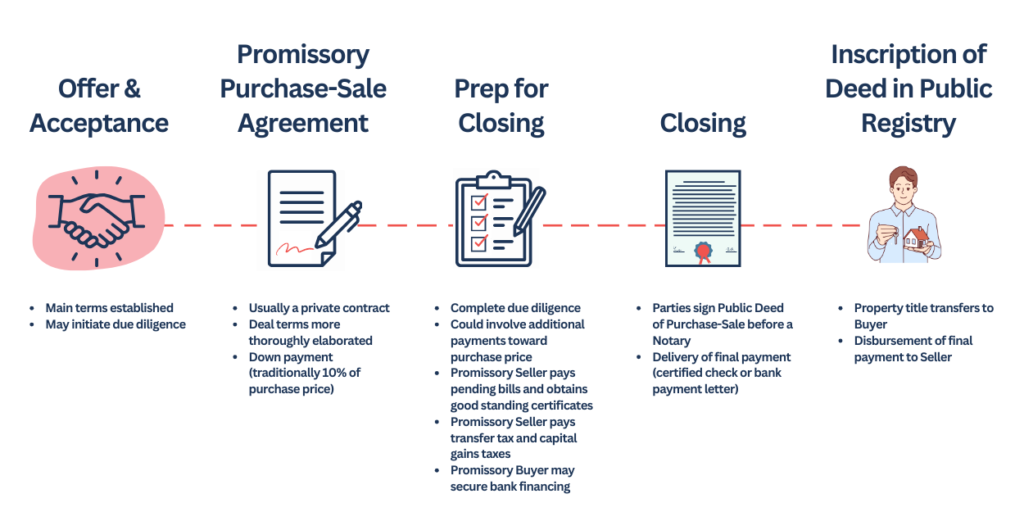

Here is a broad overview:

- Offer: The process usually begins when the buyer makes an offer on the property. The offer typically includes a price and general payment terms. It may be presented through a real estate agent or directly to the seller.

- Promissory Purchase-Sale Agreement: If the offer is accepted, the parties enter into a Promissory Purchase-Sale Agreement. This is usually where most of the negotiation takes place, as this agreement outlines all the commercial terms, conditions, and contingencies of the sale transaction.

- Down Payment: This is the first payment of an agreed payment schedule. The standard down payment is around 10% of the purchase price, but the parties could agree otherwise.

- Due Diligence: The buyer’s attorney conducts legal due diligence on the property to verify its legal status, ownership history, and any potential encumbrances or liabilities. This could start before the down payment.

- Preparation for Closing: The seller pays all the taxes that the property sale will trigger. The seller also pays any pending bills and obtains various good-standing certificates that will be required to transfer the title. Meanwhile, the buyer usually prepares the public deed in anticipation of the Closing, unless you are buying from a developer or a bigger real estate company.

- Closing: The buyer and seller meet to sign the public deed before a notary. This is usually when the buyer pays the remaining balance of the purchase price. However, the property title will not legally transfer to the buyer until the public deed is inscribed in the Panama Public Registry. So, the buyer’s lawyer will usually structure the transaction so that the seller receives the final payment only once that process in the Public Registry has been completed, often setting up some type of an escrow arrangement.

That is just a broad overview of a regular real estate transaction in Panama. If you want to read more about this, then check out our article: How Does a Real Estate Transaction in Panama Work?

The most important thing to note is that in a regular real estate transaction, the object of the transaction is the real estate itself. The real estate is what changes hands between the seller and the buyer. But this is not the case when you buy and sell real estate by transferring shares of the S.A. company that owns the property (a “Sale of Shares” transaction).

Selling Real Estate Held in an S.A. Corporation

A Sale of Shares transaction works similar to a regular real estate transaction, but there are a few key differences:

- Scope of Due Diligence

- Promissory Contract

- Delivery of Documents

- Tax Payment

- The Closing

Let’s briefly touch on each of these key differences.

Scope of Due Diligence

Any time you buy a real estate property, you will want your attorney to run legal due diligence on the property. In a regular real estate transaction, this mainly consists of a “title search” to verify that the seller actually owns the property or is authorized to sell the property on behalf of the owner. Apart from verifying the clean title, your attorney will also check that registered measurements and location match what you think you are buying, that any construction on the property has been properly registered, and that there aren’t any liens on the property or restrictions of which you may not be aware.

However, in a Sale of Shares transaction, the scope of the legal due diligence has to be expanded to include the S.A. company. Your attorney should verify that the seller is authorized to sell the shares of the S.A., who are its Board of Directors and resident agent, and that there aren’t any debts, liens, or lawsuits registered against the company.

Your contract may also include some additional declarations on the part of the seller, such as a declaration that the S.A. corporation is not a party to any contracts that have not been disclosed or that it has never had any employees that might come out of the woodwork with a surprise labor claim.

That’s because when you buy an S.A. corporation, you are buying all of its liabilities and contractual commitments. So, you want to avoid surprises.

Want to read more about Due Diligence in a real estate transaction? We’ve written an article about that as well.

Promissory Contract

As we saw above, in a regular real estate transaction the parties usually start by signing a Promissory Purchase-Sale Agreement. But in a Sale of Shares transaction, you sign a Promissory Puchase-Sale of Shares Agreement to purchase the shares of the S.A. corporation.

These contracts are similar and serve the same purpose. But some of the key components are different.

In a Promissory Purchase-Sale Agreement, the real estate itself is the object of the transaction. It is what changes hands between the seller and the buyer. And the owner of the real estate appears as the seller which could be a person or a corporate entity such as an S.A. company.

But in a Promissory Puchase-Sale of Shares Agreement, the object of the transaction is the S.A. company, which owns the underlying real estate. And the shareholder(s), or a representative of the shareholder(s), will appear in the contract as the seller.

Take a look at these two example real estate transactions. In each one, the real estate is held in an S.A. But in the first transaction, the real estate is sold directly. The second transaction is a Sale of Shares, in which the shares of the S.A. company that owns the real estate are transferred from the seller to the buyer:

In the first transaction, the S.A. company would appear as the seller in the Promissory Purchase-Sale Agreement. But in the Promissory Puchase-Sale of Shares Agreement, the shareholder(s), or a representative of the shareholder(s), appears as the seller. And the buyer will acquire the shares of the S.A. company itself.

In the Sale of Shares transaction, the buyer acquires the shares of the S.A. company. So, the buyer becomes the new shareholder of the S.A. company, which in turn owns the real estate. But technically speaking, the owner of the real estate itself never actually changes. And there is no public deed to transfer the property title.

Delivery of Documents

As we said, in a regular real estate transaction, the real estate changes hands between the seller and the buyer. So, the seller has to deliver the property free and clear and in good standing to even be able to transfer the property title. But in a Sale of Shares transaction, the real estate technically never changes hands. There is no transfer of title because the real estate always remains the property of the S.A. company.

Still, the seller needs to deliver the property free and clear and in good standing. But this really just amounts to a contractual obligation, since there is no public deed of transfer of the real estate title. So, in this kind of property purchase, the buyer’s attorney needs to check very carefully to ensure that any pending bills or payments were paid up and resolved for the property for the closing.

And since the “object of the transaction” in a Sale of Shares transaction includes the S.A., there is an even longer list of documents that the seller needs to provide at the closing. Among other things, the seller needs to provide the original Articles of Incorporation of the S.A., resignations of the previous Board of Directors and resident agent, revocations of any Powers of Attorney that the S.A. has granted, and the company’s share registry.

Oh, and also the stock certificate(s) of the S.A. corporation endorsed to the buyer. That’s also pretty important.

Tax Payment

The taxes on a Sale of Shares transaction are also a bit different from the taxes on a regular real estate sale.

On a regular real estate sale, there are 2 types of taxes that the seller usually has to pay:

- a 2% transfer tax; and

- a 3% advancement toward capital gains tax.

It actually gets a bit more complicated than this, and you can read all about the nuances in my article about Taxes on a Real Estate Sale. But for our purposes, let’s just assume that 2% + 3% in taxes need to be paid to Panama’s tax authority (the “DGI“).

Things work a little differently in a Sale of Shares transaction. Instead of a 2% and 3% tax, there is typically just one single tax. It is calculated as 5% of the gross sale value as an advancement toward the capital gains on the transaction. Again, there is a little more to it than that. But for the purposes of this discussion, let’s just say it is a single 5% tax.

You may be thinking that this seems like the same thing. A regular real estate sale triggers 2% + 3% in taxes, and a Sale of Shares triggers 5% in taxes. That sounds like “a distinction without a difference”.

But the fact that there is no public deed of transfer of real estate property title means that there is no direct evidence that the sale ever took place. This makes it relatively easy for these types of transactions to fly under the radar of the tax authorities. And it creates a big incentive for some people to simply not report the transaction to the Panamanian government and not pay any tax at all!

So, to counter this incentive for bad behavior and to pressure people to pay taxes on this type of transaction, the law allocates the responsibility for paying the taxes on a Sale of Shares to both the seller and the buyer. While in a regular real estate sale the seller pays the taxes so that the property can be transferred, in a Sale of Shares transaction the contract usually says that the buyer will retain 5% from the final payment and pay the taxes on the seller’s behalf.

So, the non-payment of the taxes requires both parties to agree not to pay it. Most buyers are not willing to take on that type of risk just so the seller can save a little money, so this helps to ensure that the taxes are paid.

To be clear, evading taxes is illegal. But I think this is something you should understand in case a counterparty in your real estate transaction ever pitches this type of idea.

The Closing

As we said, in a Promissory Purchase-Sale of Shares Agreement, the “object of the transaction” is the S.A. rather than the property itself. That means there is no public deed of transfer of property title for the real estate. Therefore, the closing of the property sale is an entirely private transaction when the seller hands over the documents related to the property and the S.A. company to the buyer. And since the shares can just be endorsed and handed over to the buyer, there is usually no need to set up an escrow account as is often done for the final payment in a regular real estate transaction until the title transfer of the property is inscribed.

In fact, the only evidence of the sale that is often publicly available is that the buyer will usually change of the Board of Directors and resident agent of the S.A. to the people he or she has decided to appoint to those positions.

Why Structure a Real Estate Transaction as a Sale of Shares?

There are a few reasons people do this:

Asset Protection

For one thing, there are all kinds of benefits to holding a real estate investment in an S.A. We touched on why you may want to own property this way at the beginning of this article, but you can read more it here. And buying a property in an existing S.A. corporation just means you can avoid the cost and hassle of setting up a new company.

Also, there usually isn’t any substantial additional cost to structuring a transaction nthis way. A local lawyer will usually charge the same legal fees for a Sale of Shares transaction as they would for a regular real estate deal.

Privacy

Another reason people may want structure their property purchase this way is that it affords privacy. A sale of shares of an S.A. is an entirely private transaction that does get recorded in Panama’s Public Registry. So, if you prefer to keep your property investment private, then buying the property by acquiring shares of the S.A. that owns it is an easy way to do it.

Ongoing Property Tax Implications

Finally, the most important and interesting reason that property buyers like to structure their real estate purchase as an acquisition of the shares of the S.A. that owns the property… This is because structuring a transaction this way can represent significant savings with respect to ongoing property taxes. This is most relevant when the property’s registered value is significantly lower than the current market value of the property.

In the Sale of Shares transaction, the shareholders of the S.A. that owns the real estate change. But technically speaking, the owner of the real estate itself never actually changes.

You see, when a property is sold there is an adjustment to its registered value to reflect the sales price (presumably at the current market value). But, as we have seen, when a property is transferred via a transfer of shares of an S.A. company the property is never actually “sold” from a technical standpoint. So there is no update to the registered value and no property tax increase.

Here is an illustrative example:

Let’s say you bought an apartment 10 years ago for $150k, holding it in a sociedad anónima (S.A.). The registered value at the time of purchase was $150k. You would have paid property taxes on this basis for the past decade.

Now, someone has offered to buy the same apartment from you for $450k. If they purchase the property directly, then the registered value will be adjusted to the new $450k price. And this will serve as the basis for calculating property taxes going forward.

However, if they acquire the shares of your S.A. to purchase the property, the registered value will remain at $150k. This lower tax basis will likely save the buyer money in the long run.

You can read more about this as it relates to residential properties in our article about Calculating Property Taxes in Panama. The article even includes a little Excel model that you can download to calculate property taxes on a property.

Property Ownership for Residency Application

A lot of our clients initially get into the Panama real estate property market when they are applying for residency in Panama. In fact, many people start looking at properties and talking with real estate agents during their Panama relocation tour. So, if you are applying for Panama residency, then you may be wondering if this article is even relevant for you.

Fortunately, the most popular residency visa programs allow for the use of a corporation to hold qualifying real estate investments. The Friendly Nations Visa for Investors, the Self-Economic Solvency Visa, and the Qualified Investor (“Golden”) Visa all specifically permit applicants to hold their real estate investment in an S.A. So setting up a property transaction this way can play a key role in applicants’ path to permanent residency in Panama.

Bottom Line?

In Panama, it’s common for investors to buy and sell real estate by transferring shares of the owning company (a “Sale of shares” transaction). This is most often done with an S.A. entity used to hold the property.

This kind of transaction structure is popular for several reasons. Apart from all the benefits of using companies for real estate investing, buying real estate by acquiring shares of an S.A. offers privacy. And since real estate title never technically changes hands, there is no adjustment to the registered value of the real estate that is used to calculate property taxes. Many properties have registered property values far below their current market values, so this can mean significant savings in ongoing property taxes for the buyer.

And these transaction structures are 100% legal so long as you handle the taxes on the transaction appropriately. Sure, some people have used this deal structure to evade capital gains taxes (we don’t recommend that). But there may also be significant legitimate property tax savings that are completely above board.

Be sure to seek the professional advice of a local attorney to understand how this type of transaction structure may be a good idea to implement in your real estate purchases.

Be sure to check out the other articles related to real estate, and also to send us any questions at info@theindependentlawyer.com.