When someone begins researching Panama residency, they often initially focus on the rules and parameters around the different visas, the documents and requirements to qualify, and timelines.

The cost is also a major consideration, but many people initially focus on just one global number—the price tag.

What gets less attention—and what may cause more confusion than it should—is how payments break down and what is actually covered.

At The Independent Lawyer, we believe clarity around pricing is not just a courtesy. It’s part of doing the job responsibly. So let’s walk through how our billing works.

This explanation about how we bill applies for any residency applicaiton process, whether you are considering the Pensionado Visa, the Friendly Nations Visa, or another Panama residency strategy.

Fixed Quotes, Agreed in Advance

Our pricing is always fixed and always agreed upon before work begins.

Once we understand:

- your family composition,

- the residency strategy you are pursuing, and

- the scope of services required,

we provide a written estimate that breaks down all of the expected costs.

That estimate is designed to give you predictability. Immigration is already complex, so the pricing shouldn’t be.

What’s Included in a Panama Residency Estimate

A complete residency application involves more than legal analysis. It includes coordination, compliance, and execution. For that reason, our estimates are divided into three components.

1. Third-Party Expenses (Per Applicant)

These are direct, local expense items associated with processing a residency application here in Panama, including:

- copies and notarizations,

- local authentications,

- government cards and filings,

- the cost of the little plastic ID cards, and

- certified translation of documents from English into Spanish,

To be clear—these are direct, local expenses. The cost of gathering your docs from outside of Panama is not included (even though we will provide guidance). Neither are your flights, hotels, meals or Uber rides to the appointments (even though we are happy to recommend areas to stay in Panama City and some of our favorite restaurants in Panama City).

We intentionally include all foreseeable direct, local expenses so clients are not surprised later by small but necessary costs. Generally, there should not be any additional or variable expenses directly related to your residency in Panama. If we’ve made a mistake in calculating the local, direct expenses, then we have to eat the cost.

The only occasional exception involves documents in languages other than English. In those cases, a certified translator must be identified and quoted once the document is reviewed. And, chances are, we may have not yet had the opportunity to review a document like that at the time we provide the initial estimate.

2. Legal Fees (per family)

Legal fees reflect the work that only a licensed immigration law firm can do, including:

- preparing and reviewing your file,

- processing and submitting documents,

- scheduling and attending required appointments with you, and

- guiding you through each stage of the residency process

In other words, the legal fees are how we pay our staff, keep the lights on, and keep the hot coffee flowing.

There is an important difference between explaining how a process works and being responsible for the outcome of that process. Our role is not to just to provide general information about relocating to Panama—it is to carry the matter through, respond to issues as they arise, and stand behind the work. The legal fees cover our time, attention, experience and expertise.

3. Sales Tax

In Panama, legal services are subject to 7% sales tax, calculated on legal fees only. This is itemized clearly in every estimate.

Our Two-Installment Structure

Once an estimate is accepted, we issue a short engagement letter confirming scope and price. That engagement letter divides the total into two separate installments:

First Installment (Paid at Engagement)

This covers:

- 100% of the quoted third-party expenses,

- 30% of the legal fees from the quote, and

- the corresponding sales tax.

This ensures that mandatory costs are funded from the outset and that work can begin immediately.

Second Installment (Paid in Panama)

This covers:

- the remaining 70% of legal fees, and

- the corresponding sales tax.

The second installment is paid when you arrive in Panama for your Residency Launch meeting.

Together, the two installments always add up to the estimate you accepted—no more, no less.

A Simple Example

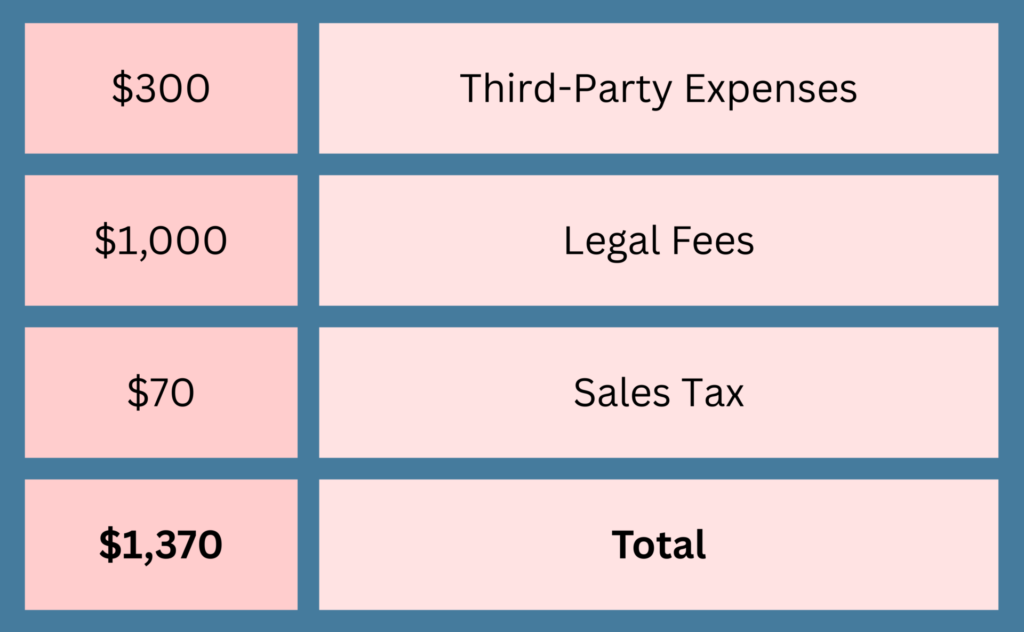

Let’s say that the estimate for your residency application includes:

The first installment would be $621. That includes all of the quoted third-party expenses ($300) + 30% of the legal fees ($300) + the sales taxes on the part of the legal fees being paid ($21). So, you would pay $621 upon engaging our office.

The second installment would be $749. That includes the remaining 70% of the legal fees ($700) + the sales taxes on the part of the legal fees being paid ($49). So, you would pay $749 at the residency launch meeting in Panama.

The math always reconciles back to the original estimate — in this case, $1,370.

When Would a Price Ever Change?

Only if the scope of services changes.

Here are a few examples of how the scope could change:

- adding or subtracting a family member to your application,

- requesting an additional work permit,

- asking us to assist with a driver’s license or bank account while you are in town,

- requesting review of a lease or contract for an apartment you saw while you were here, or

- arriving with an expired document (or forgetting to bring a document) and asking us to help you replace it urgently.

But even in those situations, we will discuss changes before doing the additional work.

And for the scope initially quoted, the price is the price.

Why This Matters When Choosing an Immigration Lawyer in Panama

Much of the confusion we see around billing doesn’t come from bad intentions—it comes from second-hand guidance and high-level explanations that gloss over important details.

Our job is to try to explain things in a simple and digestible way, while also making sure that you understand and internalize the key takeaways. Expat blogs, relocation guides, social media posts and marketing materials can describe immigration processes at a high level—but we have to account for all the nuances around things like:

- timing issues,

- document validity, and

- administrative discretion.

Those details are where residency applications succeed or fail. So, choosing an immigration lawyer in Panama isn’t just about information. It’s about accountability.

Bottom Line?

If you ever have questions about an estimate or engagement letter, we encourage you to ask.

Clear Communication Is Part of the Service. And transparency and predictability are core to how we work.

Our role is to guide clients through a complex legal process with clarity and confidence—and that includes how we bill.

Did this article strike a chord? Send us an email at info@theindependentlawyer.com.