A couple of weeks ago we exchanged emails with a new client who owns a handful of real estate assets in Panama. He holds the assets under two different S.A. entities, but the legal structure isn’t really based on any specific holding strategy. Now he is acquiring some more real estate, and he is a little worried about asset protection:

“Should I divide the new apartments in the SA’s? Or what about opening another one? Do you do foundations? We thought about moving everything into a foundation. Please let me know if this is the best option.”

We get questions like this all the time. And with good reason. Most people are aware that the right holding structure is extremely important when it comes to shielding your investments from potential threats. But it can be challenging to understand what this means practically speaking when it comes to asset protection planning.

Many people also have at least a vague idea that there are other potentially significant considerations when setting up an asset-holding structure. Things like tax consequences and ensuring a smooth transition of wealth to your heirs. But they may not feel confident about the pros, cons, and practical implications of the various options.

In reality, there is no one-size-fits-all “best option” when it comes to asset holding structures. Or another way to put it is that the most robust structure for protecting your assets in Panama is not always the “best” structure when it comes to other important considerations. The most favorable holding structure for you will depend on your investment profile, risk appetite, and individual circumstances and priorities.

In this article, we will discuss some of the various legal structures available in Panama. And I’ll take you through the way I think about the holding structures that are most relevant for my clients so that you can make more confident and informed decisions.

Let’s dive in!

Thinking about Asset Protection Strategies

This is often the starting point when a client wants to explore legal structures to hold their real estate assets in Panama. When you’ve worked hard to achieve the means to be able to acquire real estate assets, one of your greatest fears may be that someone comes and tries to take them away from you. And some attorneys would be happy to capitalize on this fear – selling you on the idea of a heftier, more robust holding structure than you may need.

But the legal structure you choose to protect your assets is usually a question of healthy risk management rather than altogether risk elimination – similar to choosing an insurance plan. The answer isn’t always to arm yourself up to the teeth.

The “best” legal structure for any given portfolio depends on the underlying assets and how the owners prioritize the multiple competing interests at play: What do you plan to do with the asset’ How long do you plan to hold it? What are your plans for the asset in the event of your passing?

The cost is usually a relevant factor as well. Here are a couple of realities that it makes sense to consider:

- Legal entities cost money to set up.

And the cost quotes may vary considerably between different entity types and lawyers. - Legal entities cost money to maintain.

I am talking about the annual “tasa única” and “resident agent” fees. And also possibly having to contract the services of a bookkeeper, and in some cases the cost of filing an additional tax return. - It is usually more cost-effective to think about holding structure when you first acquire an asset.

Restructuring can be expensive. But a good lawyer should help you think about ways to at least minimize the tax consequences of restructuring. You can read about a few tax-minimizing restructuring tools here.

Multiple Separate Legal Entities for Liability Limitation

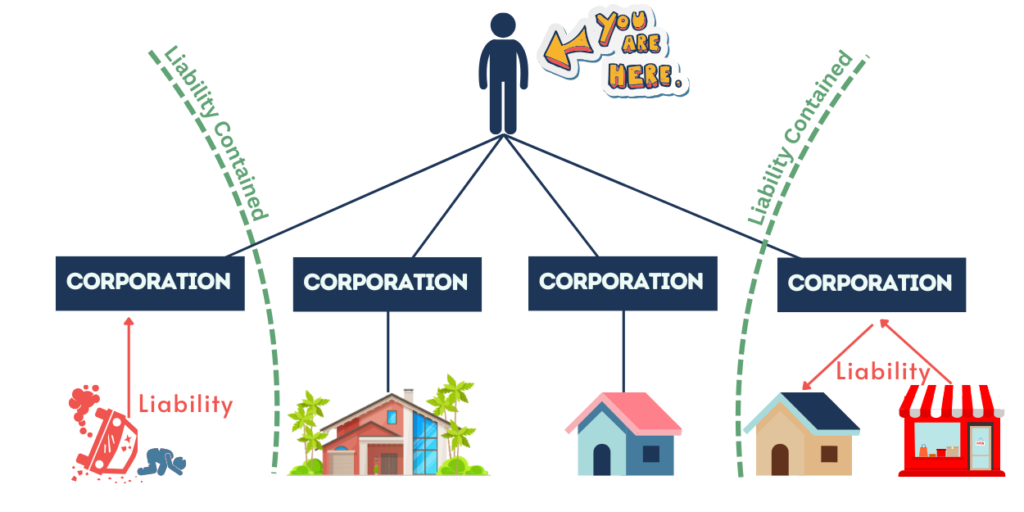

As I said, “rock-solid” asset protection is the starting point for many clients. And from a purely asset protection standpoint, the guiding theory is usually that each asset should be held in a separate corporate entity.

The reason is that each corporate entity means that any losses generally will not exceed the amount invested into that entity. This serves to contain potential liabilities so that investors’ and owners’ personal assets are not at risk if the company fails. And suppose a company with limited liability is sued. In that case, the claimants will usually not be able to reach other assets not under the direct ownership of the legal entity.

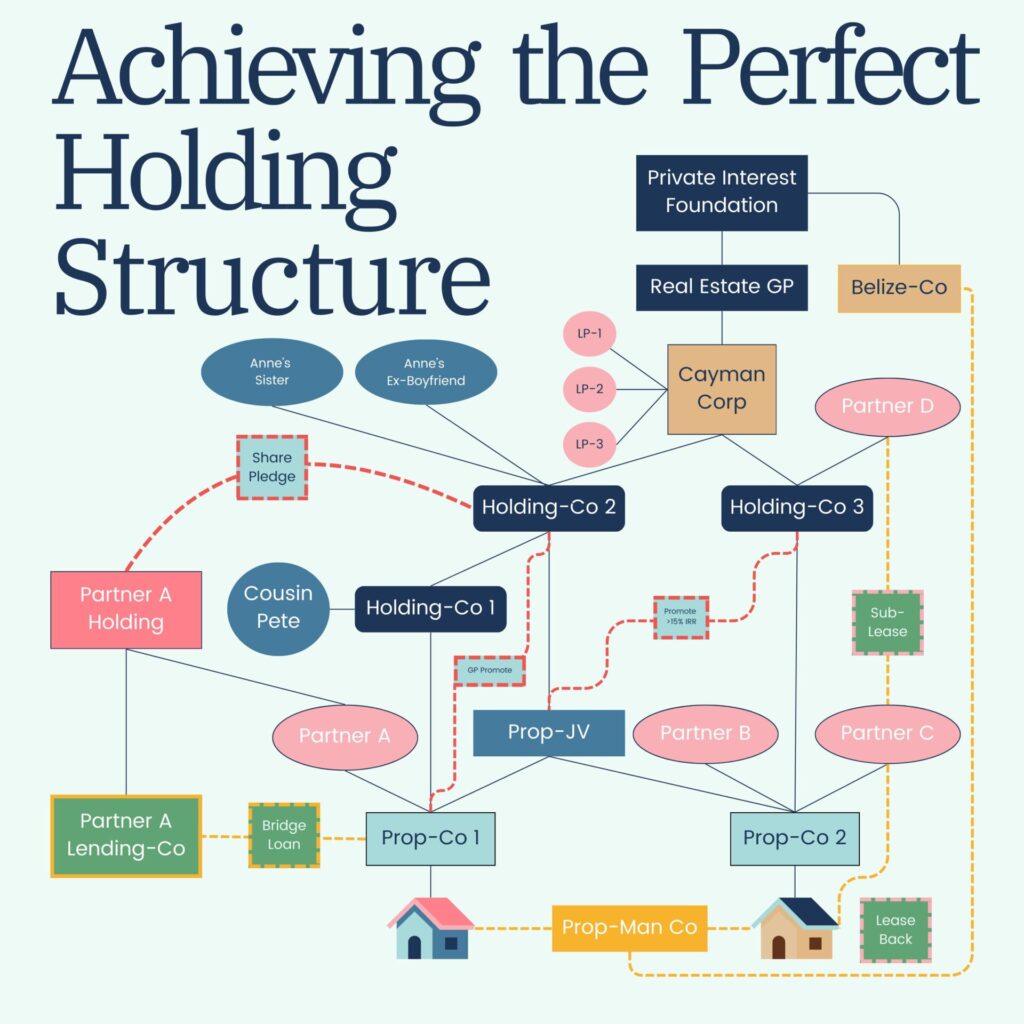

I like to think of this type of asset-holding structure as providing both vertical and horizontal liability limitations. To really wrap your head around this, take a look at the short article we published a few weeks ago illustrating The Rock-Solid Asset Protection Strategy.

The problem with putting every single asset into its own legal entity is that it can become overly cumbersome and expensive to create and maintain. It also means that every single legal entity will be treated independently for tax purposes, which may not be convenient for balancing revenue against deductible expenses. And some types of entities are even subject to double taxation.

Legal Entities to Hold Assets

Panama’s legal framework allows for several different types of legal entities to hold assets. Each one has its own unique characteristics in terms of tax consequences, liquidity, facilitating partnership, privacy and confidentiality, commercial vs. personal use, convenience in succession or estate planning, and cost.

Here are a few of the different types of legal entities that our clients use most often for their investments in Panama:

No Entity (Individual Ownership)

Ok, this isn’t a type of legal entity. But not everyone incorporates around every asset they own.

Without a doubt, the simplest and least expensive way to hold an asset is with no corporation or separate legal entity at all – well, as long as you don’t get sued. Direct ownership can be risky since this form of holding structure offers no protection against potential creditors or legal disputes.

Still, this is the way many people own their primary residence in Panama.

Apart from the risks that you could be sued, there are other disadvantages of holding an asset this way. For example, title ownership is a matter of public record. This means when you want to sell the asset or transfer it to an heir, you will need to go through a process to inscribe the transaction on Panama’s Public Registry to transfer the title to the new owner. And when you do so, there will be an automatic adjustment to the registered value of the property, which will likely increase the property taxes that your buyer will have to pay.

Also, this type of holding structure isn’t great for partnerships, since real property is not particularly divisible. And this is usually not a problem for something like a primary residence, where you probably aren´t bringing on new partners.

The Sociedad Anónima (“S.A.”)

This is the most popular type of corporate entity in Panama for holding business assets or operating a business. It is also very commonly used to protect personal assets from external liabilities or claims of creditors.

The S.A. offers liability protection to its shareholder(s). It also offers shareholders anonymity, since the ownership is entirely private and is not listed anywhere in Panama as a matter of public record.

The S.A. is flexible in that it can be owned by a single shareholder or many shareholders. It is also “liquid”, in the sense that ownership of the shares can be transferred from one person or entity to another via entirely private transactions. In fact, there are some significant potential benefits to selling real estate via shares of a corporation. This makes them great for great tools passing assets on to heirs when executing a will or the by-laws of a Private Interest Foundation.

If the S.A. is engaged in any commercial activity, then it should file a tax declaration for any income generated in Panama. The applicable tax rate is generally 25%, and then there is also a 10% withholding tax on dividends to shareholders if the S.A. generates its income in Panama.

The Sociedad de Responsabilidad Limitada (“S. de R.L.”)

The name literally translates to “Limited Liability Society”, and the S. de R.L. also does offer liability protection – albeit without the anonymous component of the S.A. Rather, the identities of the owners (called “partners”) are publicly available. But the opposite of “anonymity” is “transparency”, and this can be a positive thing when raising institutional money outside of Panama.

You need at least 2 partners to form an S. de R.L. And this type of entity is generally not considered to be as “liquid” as the S.A., since bringing on new partners usually requires the express approval of the current partners, and because the ownership has to be updated in the Public Registry.

The S. de R.L. is often compared to the Limited Liability Company (LLC) in the United States. And it is similar in the sense that this type of holding structure avoids “double taxation”. But while the LLC acts as a “pass-through” entity, meaning that business profits and losses are reported on the tax returns of the owners, the S. de R.L. is subject to a tax rate of 25%, with no taxes on dividends to the partners.

The Private Interest Foundation (“PIF”)

The PIF is also quite popular in Panama for some of the same reasons as an S.A. or an S. de R.L. entity. A PIF does not have shareholders. Rather, it has a founder (or several founders) and a beneficiary (or multiple beneficiaries). The beneficiaries’ identities are entirely private, similar to the shareholders of an S.A.

The PIF is often used as a part of an asset protection strategy. It protects the founder and the beneficiaries from liabilities affecting the entity and underlying assets, and the PIF’s assets are also shielded from creditor claims against the founder or any of the beneficiaries.

While the PIF can sell assets directly just like an individual owner, the ownership of the PIF itself is not really very liquid. Still, it is often used in estate or succession planning, because its internal by-laws (the “reglamento“) act as a will. This allows the primary beneficiaries of the PIF to pass their assets on to their heirs while avoiding a lengthy probate process.

It is a bit more expensive than an S.A. or an S. de R. L. to create, and it is also slightly more expensive to maintain. However, the PIF usually does not need to submit a tax declaration.

Factors to Consider When Choosing a Holding Structure

The S.A., the S. de R. L., and the PIF are all limited liability companies, in the sense that they can all be employed as part of an asset protection strategy. But in the descriptions above, I have alluded to a few other key features of each type of entity that you should also take into consideration when deciding on an asset-holding structure.

More specifically: tax consequences, liquidity, facilitating partnership, privacy and confidentiality, commercial vs. personal use, convenience in succession or estate planning, and cost.

For a deeper dive into the different types of legal entities most often used by my clients, be sure to read our article about Which Type of Corporation Do You Need.

In the remainder of this article, I want to take a practical look at how we might use these types of legal entities in different scenarios.

Scenario 1 – Primary Residence

Ryan is a simple man with a simple life. He lives in a nice apartment that he bought 15 years ago for $300k. Despite its age, the building is considered to be one of the best in the El Cangrejo neighborhood. Ryan has a good job working for a multinational company in Costa del Este, and he is able to afford a nice lifestyle. He takes an Uber to work, goes to the gym near his house 4-5 times per week, and frequently meets friends at the bars and restaurants in El Cangrejo. He is not married, he has no children, and he has a nice girlfriend who is just fine with things the way they are.

His apartment is registered in his own name (no corporate entity).

Lately, his lawyer friend has been encouraging him to consider moving the asset into a corporate entity such as an S.A. And some people at work have told him that a lot of wealthy Panamanian families hold their real estate investments in private interest foundations (PIFs). He can’t help but wonder if he should be doing something like this as well.

Analysis

From what I can see, Ryan’s lifestyle and job do not expose him to much risk of being sued. And I wouldn’t anticipate much complexity in his estate planning, since he owns just one asset and has no dependents.

The apartment he bought for $300k may be worth much more today, so holding the apartment in an S.A. could afford some property tax savings for a future buyer. But moving the property into an S.A. is going to cost Ryan $10,500 just in transfer taxes because of the 5% annual adjustment that is applied to the registered value. Not to mention the legal fees that his lawyer-friend probably hopes to charge him to create the S.A. and run the whole exercise!

So unless Ryan is starting a family or concerned about some specific liability, my advice would be to leave things as they are.

Scenario 2 – Multiple Personal Assets

Joe and Sofia are retired and have built their dream lifestyle. Over the years they have amassed a portfolio of multiple real estate properties in their favorite parts of Panama. The portfolio includes:

- a large house in Costa del Este;

- a mountain chateau in El Valle;

- an apartment in Playa Escondida for when they want to enjoy the Caribbean coast; and

- a beach villa in Playa Venao for their frequent surf trips.

All of their real estate is fully paid for and carries no debt. They divide their time between these areas of Panama, and they are the only ones who use the units except for an occasional friend or family members who come to visit.

They have just one son, and they plan to leave everything to him in the event of their passing. They hold all of the real estate under a single S.A. entity.

Sofia’s cousin married a Panamanian lawyer, who tells her she is crazy for keeping all these assets under a single entity. He recommends putting each asset in a separate S.A., and possibly even holding those shares under a PIF.

Analysis

Joe and Sofia’s current portfolio holding structure already affords verticle liability protection. If someone sues Joe or Sofia, it will be difficult to go after the real estate held under the S.A. And since this real estate is debt-free and used mainly for personal use, there probably isn’t much reason to be concerned about liabilities arising from the assets or about horizontal liability protection between the assets.

Holding the assets in individual S.A. entities would potentially make them easier to sell one day, but we would need to weigh those benefits against the cost of creating multiple entities, transferring the assets into the entities and then covering the annual maintenance costs of the more cumbersome structure.

While the attorney is right that a PIF could serve as a will, Joe and Sofia could also just make an actual will to avoid probate. A will is a bit more complicated to execute compared to a PIF, but it would be less expensive than restructuring. And as long as they outlive their son, the shares of the one S.A. can easily be transferred to him as the sole beneficiary of the will.

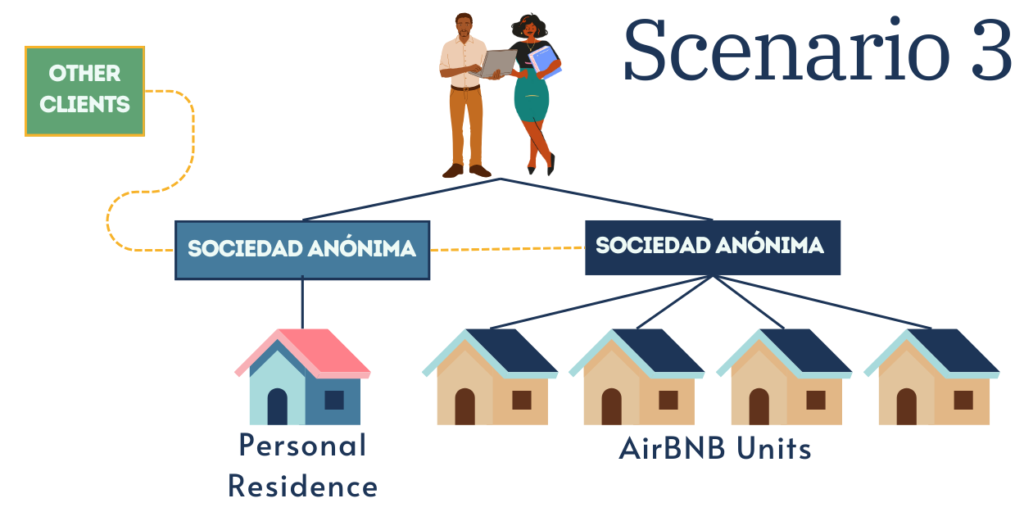

Scenario 3 – Rental Properties and a Business

Jennifer and Justin 5 apartments in Coronado. They hold 4 of the units under a single S.A. and rent them out on AirBNB. Their personal residence is held under a separate S.A., which doubles as a property management company for their AirBNB units as well as other units in the building.

They have no children, so they plan to distribute the assets to each of their various siblings when they pass away.

They spoke with the lawyer who did their Pensionado Visas, but he didn’t seem to be very confident or clear about the pros and cons of different holding structures. They are wondering if their current structure leaves them exposed.

Analysis

This is an interesting one, and this structure definitely worries me.

Their S.A. entities offer vertical liability protection for their assets. But holding their 4 AirBNB units under a single S.A. entity is a bit risky. Just imagine if a guest gets injured in one of the units and decides to sue the S.A. – all 4 of the units are potentially at risk! Holding each of the rental units under a separate S.A. entity would be much safer in terms of providing horizontal liability protection between the 4 AirBNB assets. Of course, we would need to take an honest look at how good the AirBNB business really is to assess whether the business can afford the costs of a bunch of separate legal entities.

They are also holding their personal residence under an S.A. may not be necessary. After all, there probably isn’t much risk of the asset itself being directly involved in an incident. But we would need to better understand whether Jennifer and Justing may be exposed to any liabilities on a personal level.

But they are using the S.A. that owns their personal residence to run their property management business. This actually creates a link between their personal residence and the 4 AirBNB units, as well as all the other units that the company manages! Not only that – the property management business may have employees, which subject the S.A. and possibly the personal residence to potential labor claims!

The easiest and least expensive way to correct this is to create a new S.A. for the property management business (and stop using the current one). But there will be a bit of work and costs involved in moving everything over to a new S.A., as well as an additional ongoing cost of maintaining another separate legal entity.

Finally, a PIF would be worth considering here for succession planning purposes, since Jennifer and Justin have specific plans for the assets and multiple beneficiaries. And even if they aren’t going to separate each asset into its own S.A. entity, they should consider at least organizing the assets into S.A. entities based on which properties will go to which beneficiaries. This will make it a lot easier to transfer the assets one day.

In summary, there are a few different legal structures that may be relevant for Jennifer and Justin for asset protection planning and succession planning. We could quantify the costs of executing and maintaining each structure, and then compare that cost against the risks and headaches that they should reasonably anticipate from the current structure.

Scenario 4 – A Real Estate Development

Tal and Oren are entrepreneurs who have built an extremely successful luxury real estate brokerage business in the United States. They have now teamed up with a well-known businessman Panama to execute a project developing high-end fractional ownership units on an island off the coast of Panama City. They have already secured an option on the property using an S.A. entity set up specifically for this project.

They are getting ready to do a road show to pitch the opportunity to private equity firms and other institutional investors in the US, Israel, and London. They are wondering if they have the right structure to start the fundraising campaign.

Analysis

The S.A. is fine as it will protect the project from liabilities affecting the partners and their other businesses. This vertical liability protection will also work in the other direction, protecting the partners from any lawsuits, creditor claims or other liabilities related to the Panama development project.

But Tal, Oren, and their local partner might also consider an S. de R.L. for this type of project. It sounds like the partners’ individual brands are going to be a big selling point here – so they may want to focus on highlighting the identity of the business owners rather than ensuring anonymity. And the transparency afforded by the S. de R.L. may put potential investors at ease who have only heard about Panama in the context of the Panama Papers.

They could put the S. de R.L. on top of the S.A. Or, since they are raising money, they could use the S. de R.L. as their vehicle as the Project Sponsor, and sell shares in the S.A. as the company that owns and develops the property (the “PropCo”). It would probably also be a good idea to separate different components of the business into different S.A. entities that don’t keep many assets on the books (e.g. construction, construction management, property management, etc).

Bottom Line?

So, what is the “best” asset-holding structure? It depends.

Choosing the right holding structure is not a one-size-fits-all proposition. Asset protection and limiting liability are important, but they aren’t the only considerations.

Selecting the best asset holding structure for your Panama assets requires careful consideration of your unique circumstances, investment objectives, and risk profile. It also deserves an honest look at your long-term goals and estate planning needs. The goal is to understand what you really need before setting up an impenetrable asset-holding structure that is going to cost way more than you should be spending.

And it makes sense to run this exercise when you are acquiring your assets, because it is usually less costly get it right the first time. But if you do need to do some restructuring, then be sure to work with an attorney who will help you think about how to make the changes in a tax-efficient way.

If you have questions about how this might apply to your investments in Panama, then let’s talk. You can write to me at info@theindependentlawyer.com.