This week, we are working on an article about some of the different types of legal structures that business owners and investors use for asset protection planning.

Asset Protection is not just about Dodging Liabilities

We tend to think about asset protection in terms of protecting against creditor claims and other liabilities (“limited liability“). But asset protection is about much more. We’re also talking about shielding your assets from superfluous tax hits and facilitating the easy transfer of your assets when it is time to sell or pass them to your chosen heirs. And we are also talking about how to protect yourself from the exorbitant costs of setting up and maintaining an overly cumbersome holding structure that is way more complex than you actually need.

In Panama, there are a number of different types of legal entities that can be used to hold assets. Each legal entity type is different in how it can be used for tax planning, to facilitate partnerships or asset sales, the privacy and confidentiality it offers, whether it is ideal for business assets vs. personal assets, the conveniences it affords in succession or estate planning, and costs involved in setting up and maintaining it.

You can read more about the types of legal entities that many of my clients use in an article last year: Which Type of Corporation Do You Need?

Multiple Separate Legal Entities for Liability Protection

Still, when most people think about asset protection, they prioritize limiting liabilities. And when it comes to limiting liabilities, the guiding theory is usually that each asset should be held in a separate legal entity.

To illustrate this, I am going to refer to the famous example of holding multiple taxi cabs in different legal entities. This exercise is often cited in business schools and law schools in the United States to explain the concept of using legal structures to limit liability.

Here is how it goes:

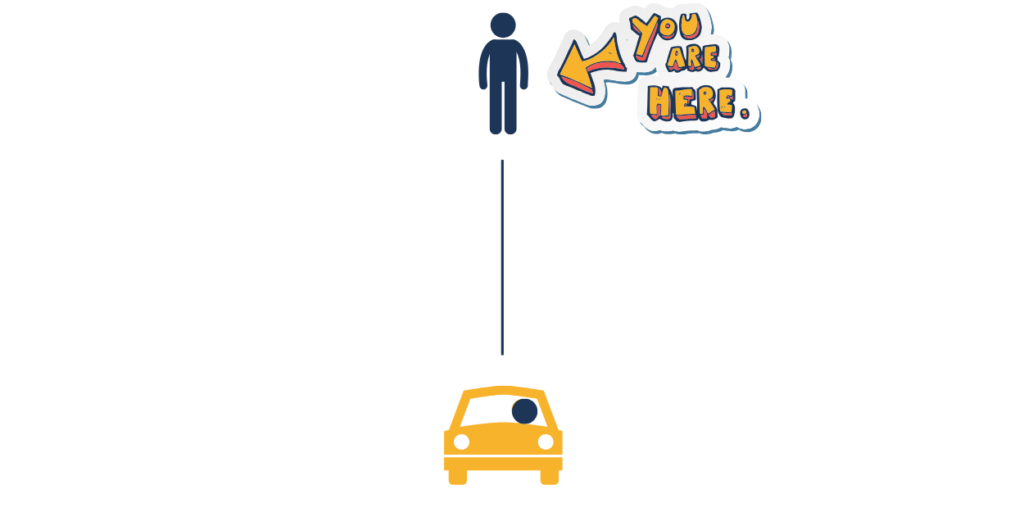

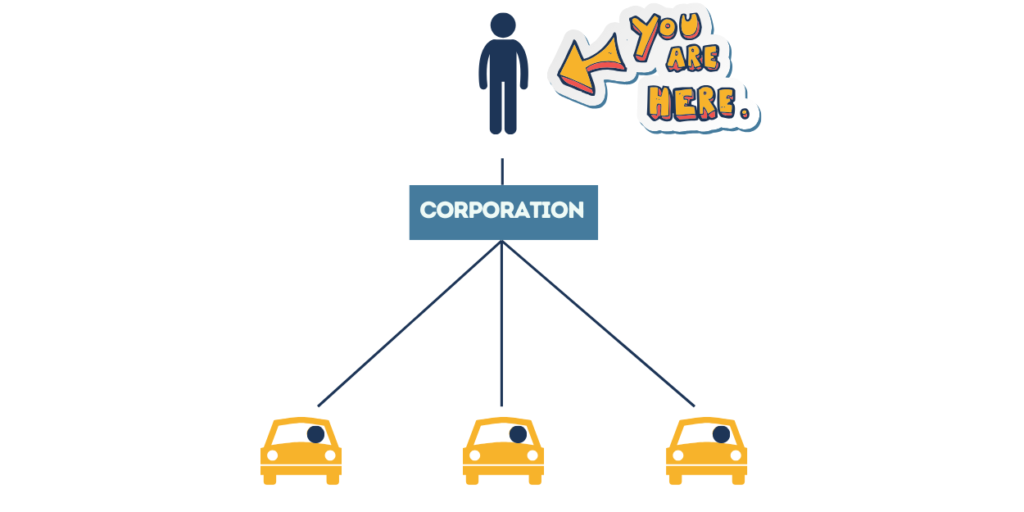

Let’s say you own a taxi cab:

Maybe you drive it yourself. Or maybe you rent it to a driver, or perhaps you pay someone to drive it for you. In any case, your taxi cab is out there on the road every single day, picking up passengers, navigating traffic, and generating revenue.

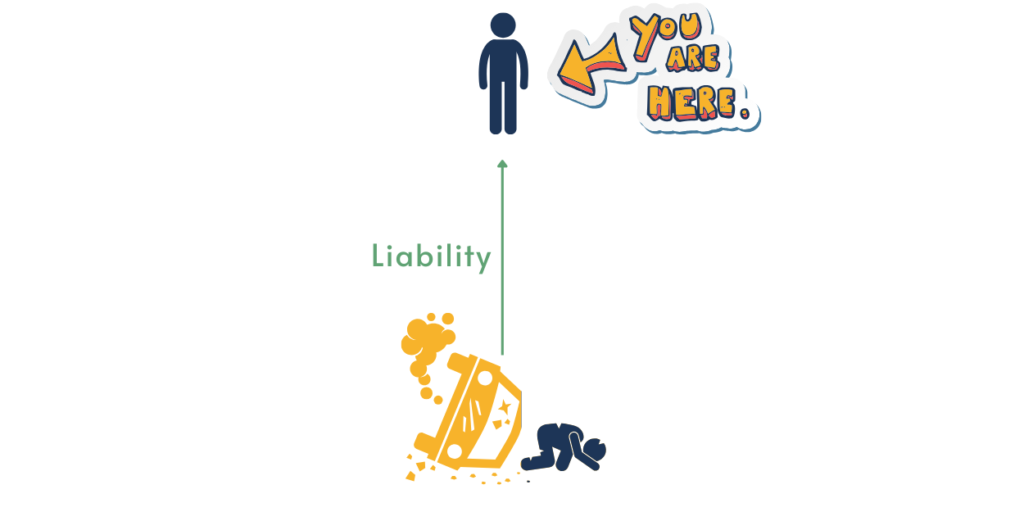

Now, imagine something happens. The taxi cab is involved in an accident, and someone gets seriously injured. Or someone’s property is damaged.

As long as the taxi is registered in your name, your bank account and other assets may be at risk of a lawsuit.

Not only that – let’s say someone sues you personally for something that has nothing to do with your taxi business. Still, the taxi cab registered in your name may be at risk of seizure. Not to mention your personal vehicle, your primary residence, your bank account, and any other personal assets.

So, are going be in the taxi business, you should probably consider putting your taxi cab into a corporation.

Holding an asset like a taxi cab in a corporation means that any losses generally will not exceed the amount invested into that corporate entity.

I call this verticle liability protection. A corporation contains potential liabilities so that investors’ and owners’ personal assets are not at risk if the company fails. In other words, the corporation protects you and your other assets from lawsuits involving the taxi cab.

And this vertical protection works in two directions – because it also protects the taxi cab from creditor claims against you or other businesses that you may own in your name. So, if somebody sues you personally, they will have a hard time going after your taxi cab.

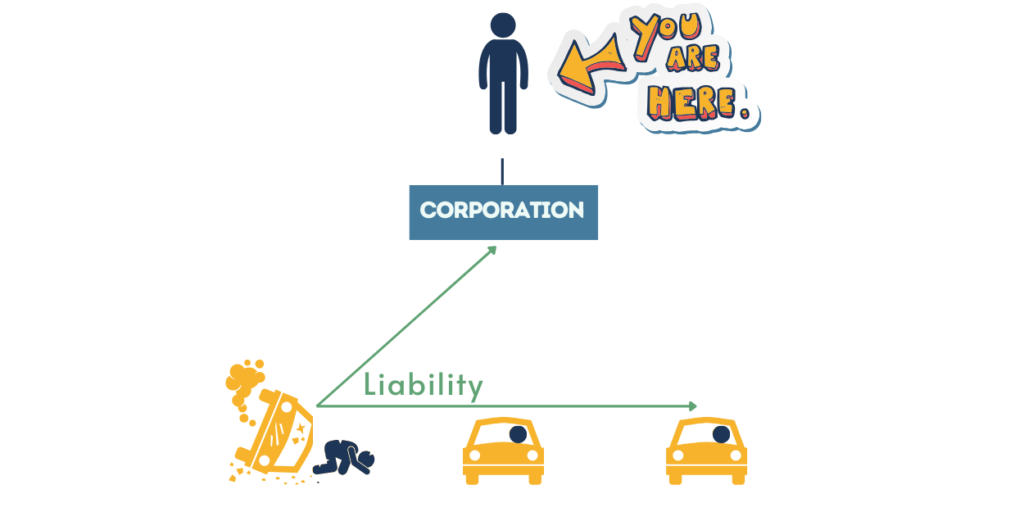

Ok, now, let’s imagine a scenario in which you own multiple taxi cabs.

You could put all of the cars into your corporation. And in most situations, this would protect you and your other personal assets from any liabilities affecting the taxi cabs. It would also protect the taxis from any claims of creditors going after you personally.

That’s fine. But what happens if car number 1 is involved in an accident and a lawsuit results?

Well, if all the taxi cabs are held under a single corporate entity, then that corporate entity as well as all of its other assets may be exposed. That means your entire fleet of taxi cabs may be at risk of becoming involved in the lawsuit.

This is because a single company affords verticle liability protection between the assets and the owner, but it doesn’t really offer horizontal liability protection for multiple assets.

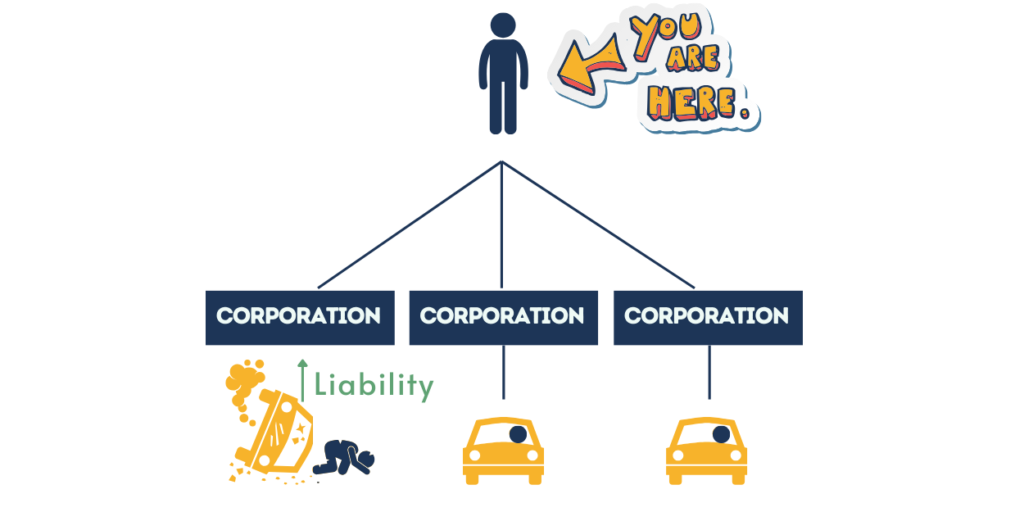

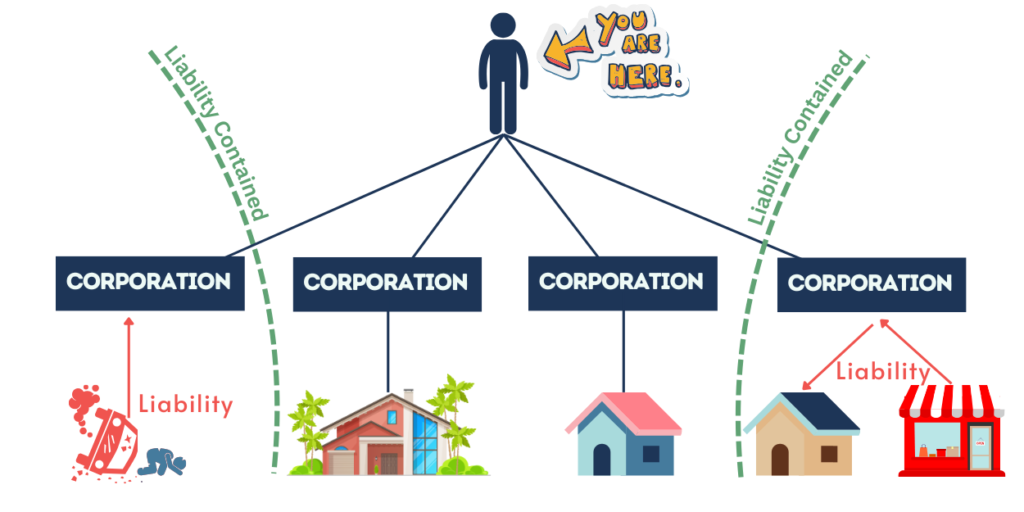

In this situation, the safer structure in terms of limiting liability would have been to hold each taxi cab in a separate corporate entity:

Do you see the logic? By holding each taxi cab in a separate entity, you can limit liabilities both vertically and horizontally. A lawsuit or claim involving one single taxi cab is unlikely to affect you or other assets held in your name (and vice versa). And a lawsuit or claim involving one single taxi cab is also unlikely to affect other taxi cabs in your fleet, because they each have different “owners”. There is no direct legal connection between the individual cars.

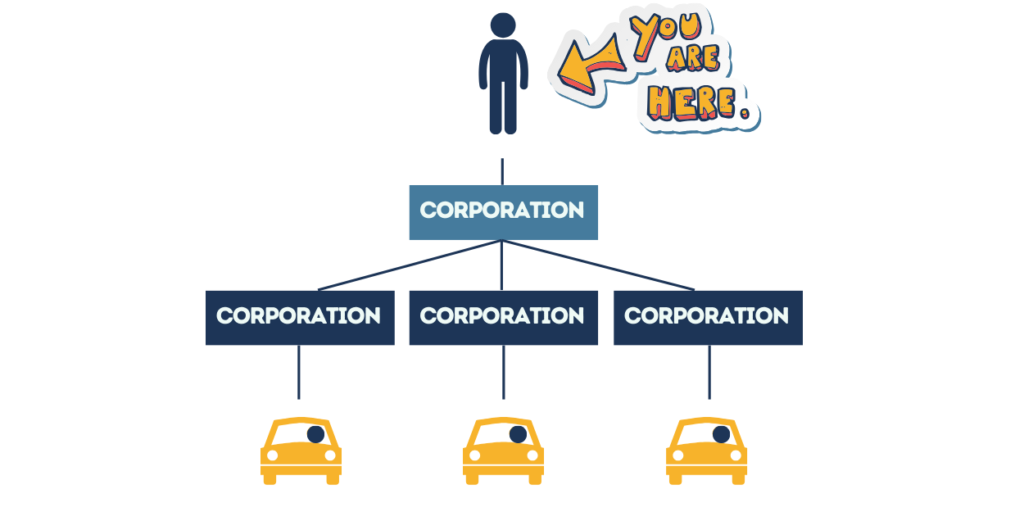

Actually, we can even take it a step further.

Here, we have added an additional corporate entity on top of the holding structure. This “holding company” may exist simply to own (or “hold”) all the companies that own each individual taxi cab.

I mentioned above that putting a taxi cab in a corporate entity will offer vertical liability protection in most situations. By adding another entity on top, and an additional layer of separation between the owners and the business unit, that vertical liability protection becomes even more difficult to penetrate.

This type of structure may also be more convenient to structure partnerships. Now you can sell some shares of the “holding company” to bring on a partner in the whole taxi cab business.

This type of structure may also work well for you for accounting purposes and for tax planning. It may also facilitate the transfer of assets when you decide you’d like to reduce the size of your fleet.

Not Just for Taxi Cabs

Most of my clients are not in the taxi cab business. Actually, none of them are.

But the taxi cab scenario is a nice way to illustrate the principal of using multiple legal entities for liability protection. Taxi cabs could be financed with debt and subject to creditor claims. The taxi business is also exposed to different types of risk (property damages, personal injury, potentially even labor claims). And taxi cabs are mobile assets that we can easily envision being subject to seizure.

But the logic of using multiple legal entities for liability protection extends to other types of assets as well. This could include liabilities arising from and affecting other types of business assets, personal vehicles, bank accounts, or your primary residence.

Cost Considerations

The problem is that our asset protection strategy of using a separate legal entity for each asset has become cumbersome and expensive. It’s like loading up on insurance. Your taxi cab fleet is well protected if something happens, but in the meantime, you have incurred expenses and legal fees in creating multiple corporate entities. And each of those entities costs money every year just to keep active and in compliance.

Be sure to read our new article that explores all the nuances of Asset Protection: What is the Best Asset-Holding Structure?

Bottom Line?

When most people think about asset protection, they prioritize limiting liabilities. People want to protect their assets from those who might try to take them away.

But practically speaking, this is not always the only important consideration. In fact, for many people, limiting liabilities probably isn’t even the most important consideration. That will be the subject of our next article.

But if you really want to create a rock-solid asset protection strategy, the best way to do it is usually by separating your assets, each into a separate legal entity. Even better if you can employ the sociedad anónima (S.A.), which offers anonímity as to the identity of its shareholders.

If you have questions about how this might apply to your investments in Panama, then let’s talk. You can write to me at info@theindependentlawyer.com.