Investing in Panama is a lot of fun. It’s a dynamic market in an emerging economy, and the country is small enough to make you feel that you have a chance to wrap your head around what is happening. It is also a beautiful country, so there is a sexy-factor that makes speculative investing even more intoxicating.

But after investing a bit and acquiring a few assets, it is pretty common to look at the little empire you’ve created and wish you had structured things differently. When it comes to restructuring assets, you will probably want to contract an attorney. And ideally you should try to engage an attorney who can help you navigate the tax consequences of different restructuring strategies.

Asset holding structures always need to be analyzed case by case, and there is no single cookie-cutter solution for re-structuring your assets. But there is one absolute when it comes to modifying your holding structure – you should do it in a tax efficient manner.

Why to Restructure your Assets?

There are many reasons clients approach me about restructuring assets. I’ll mention a few of the most common ones here:

- Tax optimization.

This one is super broad, but also very common. Especially if your properties are generating income. - Risk Management.

Let´s say you are holding your primary residence through an S.A., and you subsequently used the same S.A. to acquire an investment property. That second property is now generating a nice healthy return on AirBNB. The other night you had a dream that a guest slipped and broke her leg on the back porch (on that tile the previous owner installed that gets ridiculously slippery when wet). You woke up in a cold sweat and realized that your primary residence is at risk. - Cost Efficiency.

The annual carrying costs of an S.A. have increased over the last few years. You have to pay Tasa Única ($300 x year) + a Resident Agent fee (starts at $250 x year) + pay an accountant to keep books ($300 x year for an inactive company with minimal movements). That quadruple-layered holding structure that sounded cool a few years ago is now costing you a fortune. - Estate Planning.

You are drafting a last will and testament, or a set of by-laws for your foundation, and you realize it would be a lot more convenient if a particular asset were held under Company B rather than Company A.

One thing I want to make clear – this article is about restructuring assets in a tax efficient manner. It is not about moving an asset from one person to another. There is plenty to discuss about how to do that in a tax efficient manner as well, but that is for a different article.

The Wrong Way

So, take any of the scenarios I described in the preceding section. Whatever the reason – you want to move an asset from Company A to Company B.

Now, the standard way of moving a property from one company to another is to sell it. But that definitely triggers a tax consequence. You can read about that here: Taxes on a Real Estate Sale

But that’s precisely what you DON’T want to do. And just to be clear – there is nothing shady about legally minimizing your taxes in this situation. After all, there is no arm’s length transaction here.

And the tools I am going to tell you about involve notifying the Panama tax authority (DGI) and will also be evident on Panama’s Public Registry.

Restructuring Assets via Absorption

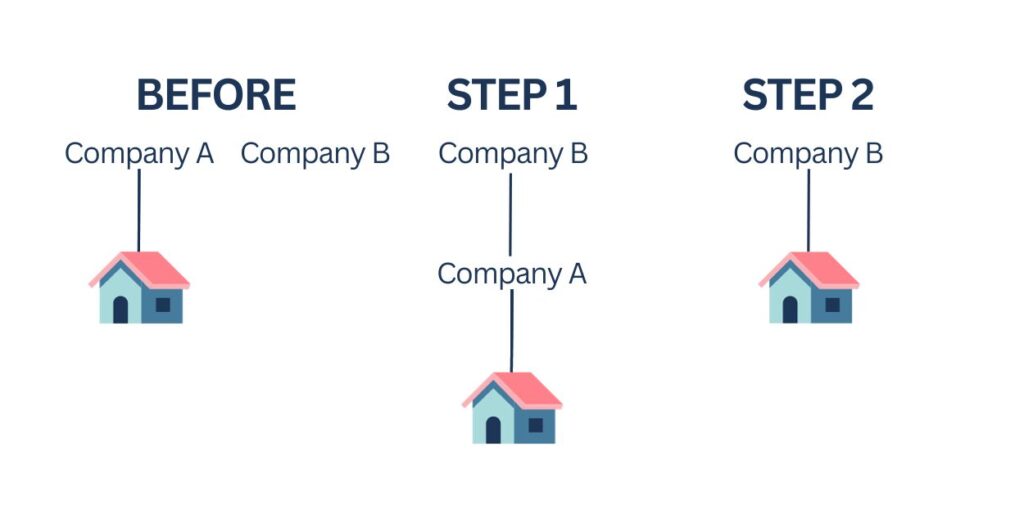

Like I said, there is no cookie-cutter solution when it comes to restructuring assets. But the absorption is one of the basic, go-to tools. The main thing to keep in mind with an absorption is that one of your corporate entities disappears. It gets eaten (or “absorbed”) by another corporate entity.

Here is a graphic to explain:

Did you get that? Company B absorbed Company A. And in effect, Company B became the owner of the real estate previously held by Company A.

So long as the shareholder(s) of Company A and Company B are the same, there is no tax consequence. And Company A disappears entirely (as well as the carrying costs of maintaining it).

By the way, the absorption often starts at Step 1. I have had met clients who have assets held under 2 or even 3 different S.A. companies all stacked on top of one another. That’s fine if you have different partners and investors who appear as shareholders at the different levels. But often times clients may have ended up with this structure because they were talked into the benefits of dual- (or even triple-) protection. And they were probably pitched this idea by the same lawyer who was getting paid to create the companies.

Restructuring Assets via Escisión

This one comes up a lot within the context of tax optimization. Here is what I mean.

Let’s say you purchase an apartment 10 years ago for $150k, and you hold it in a sociedad anónima (S.A.). I refer to this as a “Prop-co”.

The registered value was likely set at $150k when you bought it, which would have served as the basis for your property taxes over the last 10 years. But now somebody has offered to buy the same apartment from you for $450k.

If they purchase the property directly, the registered value was be adjusted to the new $450k price point. That means the buyer will pay property taxes based on $450k going forward. But if they purchase the property by acquiring the shares of your S.A., the registered value will remain at $150k. This lower tax basis will save the buyer money for years to come. You can read more about this here. But it seems like a no-brainer, right?

OK, so you’d be happy to transfer the apartment by selling the shares of the Prop-co. But what if you are holding your primary residence or another investment property under the same S.A.? You cannot sell him the shares of the Prop-co, because it holds multiple properties.

The solution is to separate the properties. Let’s move one of the properties into another S.A. that you own so that you can sell the apartment to the interested buyer by transferring the shares of the Prop-co. And if you don’t have another S.A., then it is fast, easy and inexpensive to create one.

Here is a graphic that explains what this looks like (with Company A being the Prop-co in question):

Once again, so long as the shareholders of Company A and Company B are the same, this transaction triggers zero taxes.

Bottom Line?

There are an endless number of different asset holding structures, and there is a story behind every single one of them. So, restructuring assets in a tax-efficient manner pretty much always requires a tailored analysis. That is unfortunate, because sometimes it means you’ll have to pay an attorney to unwind what a previous advisor should have told you when you were setting all of this up. My grandpa called this sort of thing “tuition in the school of life”.

Restructuring assets may be a good investment if it facilitates a transaction or helps you to achieve a leaner, or more tax-efficient holding structure. But be sure to consult with someone about how to execute it. There may more than one way to do it, and you should be aware of the immediate and ongoing costs of each option.

If you have questions about how this might apply to your asset holding structure, then I would love to hear from you. You can write to me at info@theindependentlawyer.com.