The allure of Panama… with shiny Panama City set against the backdrop of a diverse landscape, a growing and dollar-based economy, and a strategic location right in the middle of the hemisphere. Not to mention the the world economy depends on the Panama Canal.

There is quite a bit going on here for a relatively tiny country in Central America – and always a lot of people coming and going. And many of those people will decide to engage in Panama’s real estate market.

If you are thinking about buying or selling a real estate property in Panama, then you are going to want to bookmark this article. It will give you a nice digestible overview of how you can expect a Panama real estate transaction to work.

Scope of this Article

There are a couple of things you should keep in mind as to the context of this article:

Titled Real Estate

This article is specifically about transactions involving titled real estate properties. There is a system of “Possessory Rights” or “Right of Possession” (“Derecho Posesorio“) that is recognized in Panama, which allows a person to become the de facto owner with property rights over a property that does not have a title. That is an entirely different animal altogether that merits its own article (or series of articles). But this article will be all about transactions involving titled real estate.

Direct Real Estate Transfers

In Panama, it is also very common for investors to buy and sell real estate by transferring shares of the owning company, which is usually a sociedad anónima (“S.A.”) entity. This is a completely legitimate way of doing a deal. And there are some very good reasons to consider structuring a real estate transaction this way when the property is held in the name of a Panamanian corporation. You can read about that here.

But this article is specifically about transactions in which the property title itself changes hands (i.e. not a purchase-sale of shares of a corporation).

Legal Overview

Keep in mind that Panama’s legal framework is founded on civil law, which is quite different from the common law system prevalent in most of the United States, the United Kingdom, and much of Canada. As a result, the legal process for moving a property title from one party to another will also be a bit different here. Most buyers and sellers should engage the legal assistance of a reputable local lawyer with experience in transactional work to assist them with their real estate deals in Panama.

The following are a few interesting elements to be aware of in a Panama real estate transaction. If you want to skip this, you can jump down to How it All Goes Down.

Panama’s Public Registry

You should also be aware that titled real estate transactions in Panama take place on Panama’s Public Registry. This is a Panamanian government institution responsible for recording and maintaining various public legal documents related to real estate, companies, and other legal entities. When it comes to Panama real estate, the Public Registry records transaction deeds, mortgages, and property titles. This helps establish legal ownership, encumbrances, and other relevant details for real property.

To legally transfer ownership of real estate in Panama, a transaction contract must be registered with the Public Registry in the form of a Public Deed of Purchase-Sale.

One more thing – you don’t have to be an attorney to access and use the Public Registry. It’s a pretty fun tool to know how to use. OK – “fun” may be an overstatement. But it is an extremely useful resource, and you can learn to navigate it yourself pretty easily.

Due Diligence

When you buy a real estate property in Panama, you should have your attorney run due diligence on the property. This is a good rule of thumb when investing in real estate anywhere in the world. However, the Panama legal system and history of property ownership have their own intricacies that need to be taken into account by a local attorney when conducting due diligence. The most seasoned real estate investors know that when investing in a foreign country they should engage the professional advice of a real estate attorney who knows the right questions.

One of the first articles we wrote on this blog was all about due diligence in a real estate transaction. You can read that article here.

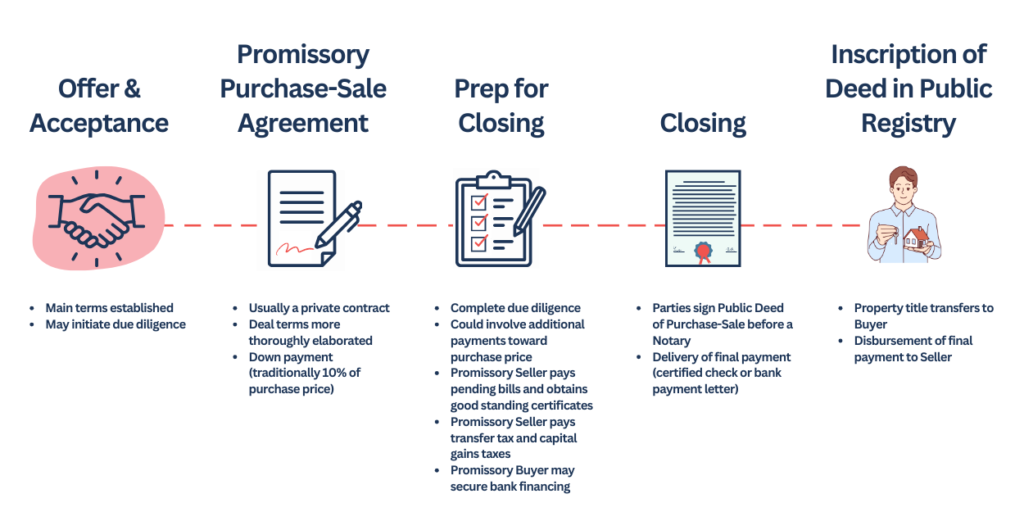

Transaction Contracts

Once an offer to buy the property has been accepted, the parties will usually sign a Promissory Purchase-Sale Agreement (a “Contrato de Promesa de Compraventa“). This is typically what people mean when they refer to the purchase agreement. It outlines the commercial terms and conditions of the sale, including the purchase price, property details, payment terms, and other declarations, commitments, or special provisions that have been negotiated as part of the deal.

The Promissory Purchase-Sale Agreement is a private document that will usually only be seen by the parties, their attorneys, and possibly the Seller’s bank to explain the incoming wire transfers or deposits. There will almost always be some back-and-forth negotiations about language and terms. It is important for both parties to thoroughly review and understand this document before signing.

Later, when the Buyer makes the final payment, the parties will sign a Public Deed of Purchase-Sale (“Escritura Pública de Compraventa“) at a notary’s office. The Deed is usually a much less colorful document that follows a more standard format. But the main points such as the parties, parcel number and other identifying information for the property, and the price are all going to be there. The Deed will then be filed (or “inscribed”) with Panama’s Public Registry to transfer the property’s title to the Buyer.

Party Responsibilities

Generally, the Seller is responsible for preparing the initial draft of the Promissory Purchase-Sale Agreement and the payment of the capital gains tax and transfer taxes. You can read about how these taxes are calculated here.

The Seller also makes any outstanding payments to bring the property up to date on things like water, property tax, trash, electricity, and maintenance. The Seller will need to provide these good standing certificates and a condition of the signing of the Public Deed of Purchase-Sale.

Meanwhile, the Buyer will bear the costs of the due diligence on the property, as well as the cost of notarizing the Public Deed of Purchase-Sale and having it inscribed in the Public Registry.

In a transaction between individuals, it is common for the Buyer’s attorney to draft the Public Deed of Purchase-Sale. But if you are buying real estate from a development company, they will usually have a legal team who plans to draft it.

Each of the parties will bear the costs of their attorneys to review everything, irrespective of who drafts the contracts.

How it All Goes Down

The Listing

Panama does not have a full-fledged multi-listing service (MLS) like you find in some other countries. There has been an effort to implement one, but it has not yet been universally accepted among the many, many (MANY) people working as real estate brokers in Panama. Therefore, real estate investors have to work a little harder here to get a feel for real property values.

But most properties for sale will be listed with an asking price on one of several different platforms. Websites like Encuentra24 or Compreoalquile are good places to see a variety of real estate listings for both residential and commercial properties.

Many local real estate agents will also have listings on their websites. However, exclusive listings are not really all that common.

It is also worth mentioning that we are seeing many more people identify property acquisitions through some of the Panama relocation tour operators that are now active in the market.

The Offer

The formal negotiation usually begins with an offer. This could be an email, or sometimes it may just be a verbal conversation. However, many real estate investors prefer to draft something more formal that spells out the general proposed terms to go into the Promissory Purchase-Sale Agreement. The real estate agent will often work with the client to prepare a written offer. However, we suggest that a Buyer who is sending a formal written offer defining these details for the anticipated property purchase should consider having a local real estate attorney review the wording before sending it.

The Promissory Purchase-Sale Agreement

Once the parties agree on a sales price and other general commercial terms, the next phase is to prepare the Promissory Purchase-Sale Agreement. The Seller’s attorney will usually provide an initial draft. The Buyer and his/her attorney will then review it and provide feedback. There will usually be some back-and-forth to finalize the agreement, as this is usually where the sensitive commercial terms are detailed for the first time in binding contractual language.

Upon signing the Promissory Purchase-Sale Agreement, the Buyer will make a down payment. The standard is around 10% of the purchase price, but the parties could agree otherwise. It is common for the down payment to be made by wire transfer, direct deposit, or by check. This is often referred to as a “separation deposit” because there is an implication that the property will be taken off (or “separated” from) the market.

The down payment is usually non-refundable, unless the Seller breaches the contract or unless something serious comes up in the due diligence process. But, again – the parties are free to negotiate and agree otherwise.

For example, there may be an option for the Buyer to go out of the deal if there is some known contingency to be resolved. Or if the Buyer is concerned about being approved for bank financing, then the parties could agree to a payment schedule for the down payment. Or the parties could agree to put part of the downpayment in escrow until a certain date or milestone is achieved.

Due Diligence and Preparing for Closing

This is often when the Buyer will have his/her attorney run a due diligence on the property, or complete an investigation already started. Meanwhile, the Seller will go and pay the taxes on the transaction as well as any pending bills (utilities, maintenance, property taxes, etc) to be able to bring the property into good standing for the closing.

Broker Commissions

It is standard for real estate brokers in Panama to charge a commission calculated as 5% of the total purchase price. The Seller usually pays the broker, but under some circumstances the Buyer might pay, or the parties may agree to split the commission payment. Most brokers would probably prefer to be paid from the down payment, and most Sellers would prefer to pay the commission from the final payment. This will be negotiated and agreed with the broker case-by-case, but it is common to pay part of the commission from the down payment (30-50%), with the remainder paid from the final payment.

The Public Deed of Purchase-Sale

The Buyer will usually complete payment of the remainder of the purchase price in a single lump sum at the “Closing”. This is when the parties will sign the Public Deed of Purchase-Sale, which is usually prepared by the Buyer’s attorney. The parties will usually sign the Public Deed of Purchase-Sale at a notary public’s office, and then the Buyer’s attorney will have it inscribed in the Public Registry. With the completion of this inscription process, the title of the property is transferred to the Buyer.

How the Final Payment is Made

There is a brief period between the Closing and the moment when the property has been transferred to the Buyer, in which there is some risk that needs to be appropriately allocated between the parties.

Public Deed of Purchase-Sale is a fairly technical document, and the Public Registry is pretty bureaucratic. The rules and standards of the Public Deed of Purchase and Sale are not consistently interpreted and applied. So, it is fairly common for the inscription process to be delayed due to some small clerical detail that the Public Registry wants to see adjusted in the Public Deed of Purchase-Sale. This could require the parties to sign a revised version.

No big deal – unless the Seller has used his cash windfall to take his family on a month-long European tour. Or perhaps he has just shifted his focus to other businesses and can’t be bothered to sign the updated Public Deed of Purchase-Sale. So, the Buyer will usually make the final payment in a way that accounts for this and ensures that everyone is incentivized to get the property transferred to the Buyer as quickly as possible.

If you are buying a real estate property with financing from one of Panama’s local banks, then it is easy. The final payment will typically be paid with an irrevocable payment letter (a “Carta de Promesa de Pago” or “CPP“) issued by the bank. The CPP is a financial instrument, whereby the bank promises to disburse the funds to the Seller only once the transfer of the property title to the Buyer is inscribed in the Public Registry. So while the Seller receives assurance of payment at the Closing, the money doesn’t actually disburse until the title transfers.

And if the final payment is in cash then we would usually recommend that the Buyer replicates by delivering a cashier’s check (“cheque de gerencia“) or a bank-certified check that is delivered to the notary or to an attorney with a similar set of instructions to release the check to the Seller only once the transfer of the property title to the buyer is inscribed in the Public Registry.

This seems like a small thing, but we think it is important to keep everybody working toward the same end until the transaction is concluded.

Bottom Line?

Purchasing real estate in Panama involves a series of steps that are essential for a successful transaction. The process begins with getting comfortable with the property prices in the market. Then there is an offer and a negotiation of the terms of sale that are formalized in a Promissory Purchase-Sale Agreement. And it ends with the inscription of a Public Deed of Purchase-Sale in Panama’s Public Registry. However, the buying process can vary depending on the specific circumstances of the transaction. This is why working with a strong local attorney is usually crucial, whether you are the Buyer or the Seller in the deal.

A good commercially-minded attorney will do more than just help you not just with due diligence and navigating the bureaucracy. A good attorney will be clear on all of the nuanced risks in the particular real estate investment, and will also help to ensure that the parties’ incentives are aligned healthily until the money is paid and the title transferred.

Did you find this article helpful and informative? Be sure to send us any questions or comments by email at info@theindependentlawyer.com. And let us hear from you if you need help with your real estate deal.